Related STZ Big Lots Maintains Sheen, Hits 52-Week High - Analyst Blog AB InBev Hits 52-Week High as World Cup Frenzy Rises - Analyst Blog Bulls Charge the Street as Traders Cheer FOMC Minutes (Fox Business) Related UNF Company news for April 03, 2014 - Corporate Summary #PreMarket Primer: Thursday, April 3: ECB Outcome Awaited

With Independence Day shutting US markets down for a long weekend, next week will be a slow week for earnings reports. However, an influx of economic data will more than make up for it and give investors plenty to consider. US data is expected to show that the nation’s recovery is back on track with both jobs data and PMI data forecast to impress. Fed Chair Janet Yellen is set to speak at the International Monetary Fund on Wednesday, a talk that will be closely watched as investors look for clues about the bank’s policy tightening timeline.

Key Earnings Reports

Next week, investors will be waiting for several key earnings reports including Paychex (NASDAQ: PAYX), Constellation Brands (NYSE: STZ) and Unifirst (NYSE: UNF)

Paychex Inc

Paychex is expected to report fourth quarter EPS of $0.40 on revenue of $617.35 million, compared to last year’s EPS of $0.38 on revenue of $585.30 million.

On March 28, Merrill Lynch maintained Paychex at a Neutral rating with a $47.00 price objective, noting that competition among payroll providers was high and may have an impact on the company’s growth.

“PAYX continues to face increased competition from SaaS-based payroll providers & Intuit, among others. Management noted that both its SurePayroll (SaaS offering) and full-service offerings with added online features are growing well. We expect Paychex will compete effectively but have concerns that growth in SaaS-based payroll offerings may limit pricing power for the full-service offering over time. Paychex should benefit from an improving cyclical market and greater reliance on payroll data due to healthcare reform. However, questions remain around the competitive environment. Valuation incorporates much of the improving cycle, with PAYX trading at 22x CY15E EPS, in line with its 22x 10 year median forward P/E. We maintain our $47 price objective, based on 24.5x CY15E EPS of $1.92.”

A day earlier, on March 27, Credit Suisse had a similar opinion on Paychex with a Neutral rating and a $41.00 price target. The analysts at Credit Suisse said the company’s shares are already fully valued and that there was little upside to be seen in the near future.

“Despite investments in the business via M&A, JVs, and revamping its omnichannel user experience, PAYX's profitability continues to increase. While operating margin (ex-float) guidance suggests a sequential and y-o-y contraction we view this as conservative given the ~130 bps of expansion through the first nine months. PAYX currently trades at ~24x our CY14 EPS, a considerable premium to the peer group average of 17x). With PAYX's relatively anemic growth prospects (high-single-digit EPS growth) we do not see any significant upside to the current share price.”

On June 27, Morgan Stanley maintained Paychex at an Underweight rating, noting that competition could stifle the company’s growth.

“Although PAYX has a strong recurring revenue business model, its exposure to the smaller businesses creates potential for pricing pressure and share loss to cheaper SaaS-based solutions. High total yield but increasing payout ratio indicates slowdown in growth. Growth opportunities in HR exist but we believe these are reflected in the multiple after recent runup in share price.”

S&P Capital IQ maintained Paychex at a Strong Sell rating with a $35.00 target price on June 21, saying that the stock is notably overvalued.

“We downgraded our opinion on the shares to Strong Sell from Hold in March 2014, based largely on valuation. We see lacking top-line growth, largely reflecting a tepid expansion of the U.S. economy and persistently low interest rates. While we have noted improving domestic employment data, we believe it is more than adequately reflected in the stock price. We see the stock as notably overvalued, notwithstanding a healthy balance sheet and considerable dividend.”

Constellation Brands

Constellation Brands is expected to report EPS of $0.92, compared to last year’s EPS of $0.38.

On June 23, Merrill Lynch maintained Constellation Brands at a Buy rating with a $95.00 price objective. The firm said it expects to see strong EPS growth over the next three years.

“We look for mgmt. to provide an update to the current state of the business. Key areas of focus will be 1) Progress on Crown integration and brewery expansion plans 2) Comments on US beer industry pricing, 3) Updated commentary on wine/spirits trends in the US market. Our $95 PO is based on 21.8x CY15 EPS of $4.37. This is a 15-20% premium to its international brewer peers, which is in our view is warranted by the higher than average EPS growth (led by imported beer) we expect over the next three years. Our trade checks and recent competitor comments and results indicate that US beverage alcohol market is healthy into the upcoming summer season and that STZ trends in beer and wine have broadly held. Our PO reflects this dynamic as well as the potential for STZ to grow faster than its food/beverage peers in CY14.”

On June 21, S&P Capital IQ maintained Constellation Brands at a Strong Buy rating with a $98.00 price target. The analysts at S&P cited the company’s 2012 agreement with Anheuser-Busch as reason for their optimism.

“We view the shares as very attractive, trading at a discount to peers. In June 2012, STZ signed an agreement with Anheuser-Busch InBev SA/ NV (A-B InBev) to buy the remaining 50% interest in Crown Imports LLC that it does not already own for $1.85 billion. To address antitrust concerns from the Department of Justice (DOJ), A-B InBev agreed to sell STZ the rights in perpetuity to Grupo Modelo brands distributed by Crown in the U.S. and a state-of-the-art Mexican brewery for an additional cost of $2.9 billion. The acquisition closed in June 2013.”

Unifirst Corporation

Unifirst is expected to report third quarter EPS of $1.42 on revenue of $349.24 million, compared to last year’s EPS of $1.43 on revenue of $355.76 million.

S&P Capital IQ maintained UniFirst at a sell rating with a $96.00 price target on June 21. The analysts at S&P said they expect to see the company’s growth start to fizzle out this year.

“We see a wide range of customizable product and service offerings and high levels of customer service as underlying strengths in UNF's business. However, after benefiting over the last few years from large account sales, significant growth in its flame resistant garment business that was driven by oil and natural gas exploration, and higher pricing and merchandise recovery charges, we expect the company's top-line and earnings growth to moderate in FY 14. Our outlook is also tempered by continuing high unemployment levels in the U.S. and Canada, as UNF's Core Laundry segment revenue is largely driven by the number of employees at its customers.”

Economic Releases

After US data disappointed this week, a spate of new releases from America will be highly anticipated next week. The unemployment rate is expected to have remained constant at 6.3 percent while US employers likely added nearly 200,000 workers in June. PMI reports are forecast to show expansion in both the services and manufacturing sectors within the US as well.

Also on the radar will be the European Central Bank’s policy meeting, which is set for Thursday. The bank isn’t expected to make any moves as they eased considerably at June’s meeting, but the press conference following the meeting will likely shed some light on the bank’s expectations for the bloc’s economy now that the new easing package is falling into place.

Daily Schedule:

Monday

Earnings Releases Expected: No notable releases expected Economic Releases Expected: Chinese manufacturing PMI, Japanese Tankan survey, US pending home sales, German retail sales and Japanese housing starts

Tuesday

Earnings Expected: A. Schulman (NASDAQ: SHLM), Acuity Brands (NYSE: AYI), Franklin Covey (NYSE: FC) and Paychex (NASDAQ: PAYX) Economic Releases Expected: US ISM manufacturing PMI, US redbook, British manufacturing PMI, German unemployment rate, French manufacturing PMI, Italian manufacturing PMI, Spanish manufacturing PMI and Reserve Bank of Australia interest rate decision

Wednesday

Earnings Expected: Constellation Brands (NYSE: STZ), Synnex (NYSE: SNX) and Unifirst (NYSE: UNF). Economic Releases Expected: Chinese services PMI, US oil inventory data, eurozone PPI and British construction PMI

Thursday

Earnings Expected From: Markets Close At 1pm ET Economic Releases Expected: US ISM non-manufacturing PMI, US unemployment rate, US trade balance, European Central Bank interest rate decision, Eurozone retail sales, British services PMI, French services PMI, German services PMI, Spanish services PMI and eurozone services PMI.

Friday

U.S. Markets Closed For July 4 Holiday

Posted-In: European Central Bank Federal ReserveAnalyst Color Earnings News Eurozone Previews Forex Global Economics Federal Reserve Pre-Market Outlook Markets Trading Ideas Best of Benzinga

© 2014 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Most Popular Regarding Afrezza, FDA Statement: Rackspace Down 7% On Rumor It Can't Find Buyer Apple TV Vs. Android TV Vs. Fire TV Vs. PlayStation TV UPDATE: Credit Suisse Reiterates On Schlumberger Limited Following Impressive Analyst Meeting Pfizer, Bristol-Myers Squibb Announce Positive Opinion For Treatments #PreMarket Primer: Friday, June 27: U.S. Data Fuels Fed Rate Hike Debate Related Articles (AYI + FC) Benzinga Weekly Preview: U.S. Data In Focus Top 4 Mid-Cap Stocks In The Diversified Electronics Industry With The Highest EPS Around the Web, We're Loving...

Gross (left) told Bloomberg on Wednesday he thought Bernanke "might be driving in a fog" and said of Vice Chairman Janet Yellin, “I think she is a Siamese twin in terms of policy."

Gross (left) told Bloomberg on Wednesday he thought Bernanke "might be driving in a fog" and said of Vice Chairman Janet Yellin, “I think she is a Siamese twin in terms of policy." “He could have resigned,” Schiff (right) shot back. “He’s basing his forecast of an improving economy on a housing market that was only rising because the Fed was able to blow more air back into the bubble.”

“He could have resigned,” Schiff (right) shot back. “He’s basing his forecast of an improving economy on a housing market that was only rising because the Fed was able to blow more air back into the bubble.” “[The Fed] will talk without giving any precise answers,” Faber (left) said. “I think the bond market has already weakened significantly from the July 2012 lows, in terms of yield. If the Fed indicated that it would begin tapering, equities would be more vulnerable than bonds.”

“[The Fed] will talk without giving any precise answers,” Faber (left) said. “I think the bond market has already weakened significantly from the July 2012 lows, in terms of yield. If the Fed indicated that it would begin tapering, equities would be more vulnerable than bonds.” As for specific investment moves, DoubleLine Capital founder Gundlach (left) had harsh words for bond investors (recognizing he has a dog in the hunt).

As for specific investment moves, DoubleLine Capital founder Gundlach (left) had harsh words for bond investors (recognizing he has a dog in the hunt). Getty Images Answer: If your deductible is $500 now, increasing it to $1,000 can lower your premiums by up to 20 percent. Most insurers offer much higher deductibles, too, which is a popular strategy for people who have enough money in emergency funds to cover potential costs. Raising your deductible is a good way to reduce your premiums, and it makes you less likely to file small claims that could result in a rate hike. At Chubb, about half of the wealthiest customers choose a deductible of $10,000 to $50,000. "For homes here in Malibu that are valued at $10 million to $25 million, having a $25,000 deductible isn't out of the ordinary at all," says Derek Ross, president of Kulchin Ross Insurance Services, an independent agency in Tarzana, Calif. The higher the deductible, the bigger the premium savings. Let's say, for example, you have a policy with Fireman's Fund with a $1,000 deductible and a $3,000 annual premium. You'd save about 24 percent by boosting your deductible to $2,500, 37 percent by raising it to $5,000, 47 percent by raising it to $10,000 and 53 percent by raising it to $25,000. Compare the premium savings with the extra dollar amount at risk to make sure that boosting your deductible is worthwhile. You should file a claim only if it is at least several hundred dollars more than the deductible. "If your insurer raises your rate by 10 percent for three to five years after you have a claim, that could easily exceed the amount the insurer paid beyond the deductible," says Ross. Whatever deductible you choose, keep enough money in an emergency fund to self-insure up to the deductible -- or even a few hundred dollars more. The risk of self-insuring may not be as high as you think. The average person files a homeowners insurance claim only once every eight to 10 years, says Jeanne Salvatore of the Insurance Information Institute. You could take the money you save in premiums and add it to your emergency fund each year so that you're prepared when you do have a claim, recommends Ross. You could also use the extra money to boost your dwelling, property and liability coverage levels by tens of thousands of dollars.

Getty Images Answer: If your deductible is $500 now, increasing it to $1,000 can lower your premiums by up to 20 percent. Most insurers offer much higher deductibles, too, which is a popular strategy for people who have enough money in emergency funds to cover potential costs. Raising your deductible is a good way to reduce your premiums, and it makes you less likely to file small claims that could result in a rate hike. At Chubb, about half of the wealthiest customers choose a deductible of $10,000 to $50,000. "For homes here in Malibu that are valued at $10 million to $25 million, having a $25,000 deductible isn't out of the ordinary at all," says Derek Ross, president of Kulchin Ross Insurance Services, an independent agency in Tarzana, Calif. The higher the deductible, the bigger the premium savings. Let's say, for example, you have a policy with Fireman's Fund with a $1,000 deductible and a $3,000 annual premium. You'd save about 24 percent by boosting your deductible to $2,500, 37 percent by raising it to $5,000, 47 percent by raising it to $10,000 and 53 percent by raising it to $25,000. Compare the premium savings with the extra dollar amount at risk to make sure that boosting your deductible is worthwhile. You should file a claim only if it is at least several hundred dollars more than the deductible. "If your insurer raises your rate by 10 percent for three to five years after you have a claim, that could easily exceed the amount the insurer paid beyond the deductible," says Ross. Whatever deductible you choose, keep enough money in an emergency fund to self-insure up to the deductible -- or even a few hundred dollars more. The risk of self-insuring may not be as high as you think. The average person files a homeowners insurance claim only once every eight to 10 years, says Jeanne Salvatore of the Insurance Information Institute. You could take the money you save in premiums and add it to your emergency fund each year so that you're prepared when you do have a claim, recommends Ross. You could also use the extra money to boost your dwelling, property and liability coverage levels by tens of thousands of dollars.

Getty Images President Obama's new budget proposal includes changing a couple of key inflation calculations to something called a "chained CPI." The shift is getting a lot of attention right now because of the expected effect it will have on individuals. There are two key places where a chained CPI -- short for consumer price index -- will have a direct impact on your pocketbook: income taxes and Social Security benefits. All else being equal, over time, your income taxes will be higher and your Social Security benefits will be lower than they are under current inflation calculations. The key difference between the chained CPI and the traditional consumer price index is how the index measures consumer behavior. The chained CPI assumes that as prices rise on one product, some portion of consumers will be willing to substitute less expensive alternatives for what they used to buy. That changes the product weightings used in the inflation calculation. By incorporating information from those new product weightings, the chained CPI typically produces a lower inflation level. Here's how it works. The Impact on Income Taxes If you pay income taxes, your tax bracket is determined by the amount of taxable income you make. The cutoffs for each bracket generally rise over time with inflation. The two charts below show the IRS "Schedule X" brackets for single taxpayers; the first is for 2012, and the second is what's currently expected for 2013:

Getty Images President Obama's new budget proposal includes changing a couple of key inflation calculations to something called a "chained CPI." The shift is getting a lot of attention right now because of the expected effect it will have on individuals. There are two key places where a chained CPI -- short for consumer price index -- will have a direct impact on your pocketbook: income taxes and Social Security benefits. All else being equal, over time, your income taxes will be higher and your Social Security benefits will be lower than they are under current inflation calculations. The key difference between the chained CPI and the traditional consumer price index is how the index measures consumer behavior. The chained CPI assumes that as prices rise on one product, some portion of consumers will be willing to substitute less expensive alternatives for what they used to buy. That changes the product weightings used in the inflation calculation. By incorporating information from those new product weightings, the chained CPI typically produces a lower inflation level. Here's how it works. The Impact on Income Taxes If you pay income taxes, your tax bracket is determined by the amount of taxable income you make. The cutoffs for each bracket generally rise over time with inflation. The two charts below show the IRS "Schedule X" brackets for single taxpayers; the first is for 2012, and the second is what's currently expected for 2013:  Chart for 2012 from the U.S. Internal Revenue Service

Chart for 2012 from the U.S. Internal Revenue Service  Chart for 2013 from the U.S. Internal Revenue Service While the 39.6 percent tax rate is new for 2013, note that the other brackets have higher cutoffs for 2013 than they did for 2012. That's thanks to the inflation adjustment made to the tax brackets. If the law is changed so that the chained CPI is used, the tops of those brackets are expected to rise more slowly, exposing more of your income to higher tax rates than under current law. The Effect on Social Security Benefits Similarly, Social Security benefits are increased based on the inflation rate. By tying the payment increases to the chained CPI -- an inflation rate that grows more slowly than the current measure -- those benefit payments will grow less quickly as well. As a result, over time your Social Security checks will be smaller than they would have been under the old inflation calculation. The annual changes aren't too extreme -- they're estimated to be somewhere in the vicinity of 0.1 percent to 0.3 percent per year, depending on what the future brings. But over time, it adds up to real money for those who pay income taxes or receive Social Security checks, with official estimates in the neighborhood of $340 billion in higher taxes and lower costs over the next 10 years. Is It Better? Is It Fair? To some extent, the chained CPI is more effective at measuring the behavior changes that we all make whenever possible to save some cash. For example, if you've switched to generic medications whenever they're available, you're doing exactly what the chained CPI expects you to do. Likewise, if you started carpooling or taking the bus in response to higher gas prices, you're changing your behavior based on higher prices, just like the chained CPI projects. On the flip side, of course, not all costs are easily switchable, especially for the seniors who rely on Social Security. For instance, health care costs have been rising faster than the overall inflation rate for decades, and older folks generally have higher health care costs than younger ones do. As a result, the change to a chained CPI will very likely make the gap between income growth and health care spending growth even more painful for seniors on Social Security. The Big Picture Still, if slowing the rate of benefit increases puts off the day of reckoning for when the Social Security Trust Fund runs out of cash and slashes benefits by around 25 percent, it may be worth it. That date is currently estimated to be a mere 20 years away -- well within the expected life span of most current workers and even some early retirees. To make it worse, if the CBO's recent release on Social Security is any indication, the next Social Security Trustees' Report may even pull that date even closer. Given a choice between a slower rate of growth or a hard slash of 25 percent at some point in the not-too-distant future, neither option seems ideal. But still, a slower rate of growth is a lot less painful than waking up one day to find your sole source of income has shrunk by a quarter of its former value.

Chart for 2013 from the U.S. Internal Revenue Service While the 39.6 percent tax rate is new for 2013, note that the other brackets have higher cutoffs for 2013 than they did for 2012. That's thanks to the inflation adjustment made to the tax brackets. If the law is changed so that the chained CPI is used, the tops of those brackets are expected to rise more slowly, exposing more of your income to higher tax rates than under current law. The Effect on Social Security Benefits Similarly, Social Security benefits are increased based on the inflation rate. By tying the payment increases to the chained CPI -- an inflation rate that grows more slowly than the current measure -- those benefit payments will grow less quickly as well. As a result, over time your Social Security checks will be smaller than they would have been under the old inflation calculation. The annual changes aren't too extreme -- they're estimated to be somewhere in the vicinity of 0.1 percent to 0.3 percent per year, depending on what the future brings. But over time, it adds up to real money for those who pay income taxes or receive Social Security checks, with official estimates in the neighborhood of $340 billion in higher taxes and lower costs over the next 10 years. Is It Better? Is It Fair? To some extent, the chained CPI is more effective at measuring the behavior changes that we all make whenever possible to save some cash. For example, if you've switched to generic medications whenever they're available, you're doing exactly what the chained CPI expects you to do. Likewise, if you started carpooling or taking the bus in response to higher gas prices, you're changing your behavior based on higher prices, just like the chained CPI projects. On the flip side, of course, not all costs are easily switchable, especially for the seniors who rely on Social Security. For instance, health care costs have been rising faster than the overall inflation rate for decades, and older folks generally have higher health care costs than younger ones do. As a result, the change to a chained CPI will very likely make the gap between income growth and health care spending growth even more painful for seniors on Social Security. The Big Picture Still, if slowing the rate of benefit increases puts off the day of reckoning for when the Social Security Trust Fund runs out of cash and slashes benefits by around 25 percent, it may be worth it. That date is currently estimated to be a mere 20 years away -- well within the expected life span of most current workers and even some early retirees. To make it worse, if the CBO's recent release on Social Security is any indication, the next Social Security Trustees' Report may even pull that date even closer. Given a choice between a slower rate of growth or a hard slash of 25 percent at some point in the not-too-distant future, neither option seems ideal. But still, a slower rate of growth is a lot less painful than waking up one day to find your sole source of income has shrunk by a quarter of its former value.  Related STZ Big Lots Maintains Sheen, Hits 52-Week High - Analyst Blog AB InBev Hits 52-Week High as World Cup Frenzy Rises - Analyst Blog Bulls Charge the Street as Traders Cheer FOMC Minutes (Fox Business) Related UNF Company news for April 03, 2014 - Corporate Summary #PreMarket Primer: Thursday, April 3: ECB Outcome Awaited

Related STZ Big Lots Maintains Sheen, Hits 52-Week High - Analyst Blog AB InBev Hits 52-Week High as World Cup Frenzy Rises - Analyst Blog Bulls Charge the Street as Traders Cheer FOMC Minutes (Fox Business) Related UNF Company news for April 03, 2014 - Corporate Summary #PreMarket Primer: Thursday, April 3: ECB Outcome Awaited

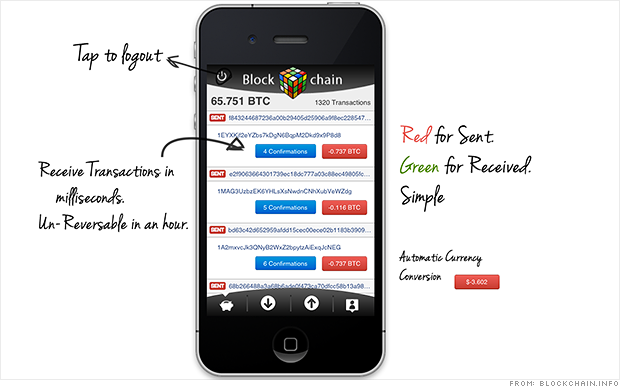

Buy this $8M mansion with bitcoins

Buy this $8M mansion with bitcoins

In a July 22 letter to SEC Chairwoman Mary Jo White, Rep. Patrick McHenry, R-N.C., chairman of the Financial Services Subcommittee on Oversight and Investigations, and Rep. Scott Garrett, R-N.J., chairman of the Financial Services Subcommittee on Capital Markets, take issue with Proposed Rule 503, which they say “requires private issuers to file a wildly expanded Form D 15 days before” they start advertising.

In a July 22 letter to SEC Chairwoman Mary Jo White, Rep. Patrick McHenry, R-N.C., chairman of the Financial Services Subcommittee on Oversight and Investigations, and Rep. Scott Garrett, R-N.J., chairman of the Financial Services Subcommittee on Capital Markets, take issue with Proposed Rule 503, which they say “requires private issuers to file a wildly expanded Form D 15 days before” they start advertising.