Yesterday, Sanofi hosted a seminar on new medicines in Cambridge, Mass., and RBC’s Adnan Butt and team note that MannKind’s (MNKD) inhaled insulin Afrezza “featured prominently enough.” They summarize the highlights of the presentation:

Reuters

Reuters MannKind's partner reiterated prior guidance that a commercial launch is planned for 1Q:15. Some had feared this timing could be retracted. In terms of pricing, Sanofi underscored that the benchmark could be rapid acting, injectable insulin, which is in line with our forecasts…

Focus on patients driving demand also important. As part of launch prep, Sanofi has conducted patient preference studies which show 60% of those starting insulin and 57% of those who need more insulin liking Afrezza's profile. The market opportunity could be meaningful given 66% of patients resist moving to injected insulin with the period of resistance being ~5 years. Patients described as the initial candidates for Afrezza include those who are on two or more oral agents and resisting moving on to injectable insulin and those who need meal-time insulin, where combined patient populations could be ~3M. Even adjusting for smokers or those with pulmonary disorders shows the opportunity remains sizable but where

greater Street confidence could require execution for a few quarters post launch.

Among other highlights: Sanofi demonstrated how much easier Mannkind’s Afrezza is to use compared to Pfizer’s (PFE) infamous flop Exubera, Butt said, and that Sanofi was in negotiations with the FDA over post-approval studies that could expand Afrezza’s use.

Shares of MannKind have dropped 0.7% to $6.11 at 1:52 p.m. today, while Sanofi has risen 0.8% to $46.95 and Pfizer has fallen 0.4% to $30.31.

ECHO... Echo... echo... NEW YORK (CNNMoney) Amazon's making another foray into the electronics business.

ECHO... Echo... echo... NEW YORK (CNNMoney) Amazon's making another foray into the electronics business.  Could this be Amazon's 'House of Cards?'

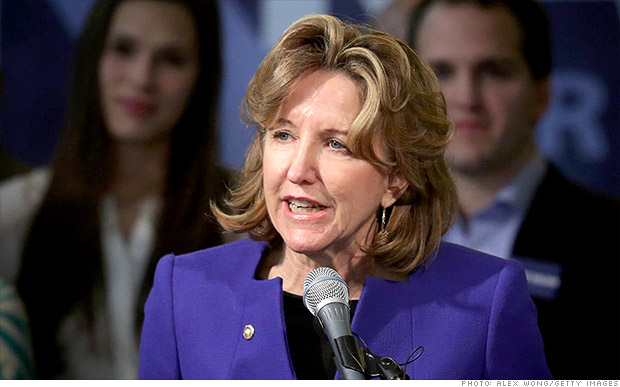

Could this be Amazon's 'House of Cards?'  Kay Hagan will receive a pension after serving just one term in the Senate. NEW YORK (CNNMoney) More than a dozen members of Congress were defeated on Tuesday night. But taxpayers will still have to keep sending most of them checks.

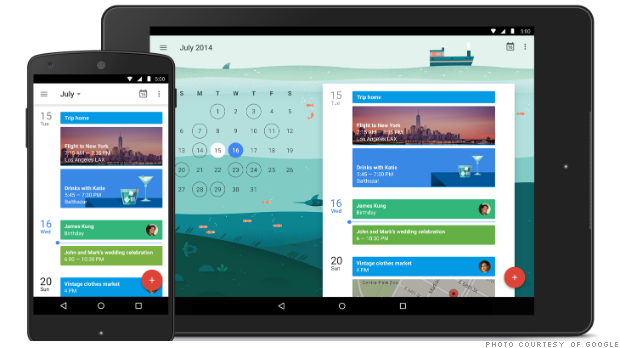

Kay Hagan will receive a pension after serving just one term in the Senate. NEW YORK (CNNMoney) More than a dozen members of Congress were defeated on Tuesday night. But taxpayers will still have to keep sending most of them checks.  The new Google Calendar is now available for Android devices. NEW YORK (CNNMoney) Google Calendar is becoming more like a personal assistant.

The new Google Calendar is now available for Android devices. NEW YORK (CNNMoney) Google Calendar is becoming more like a personal assistant.