Morning MoneyBeat is the Journal’s pre-market primer packed with market updates, insights and must-read news links. Send us tips, suggestions and complaints: steven.russolillo@wsj.com

Click here to receive this morning newsletter via email

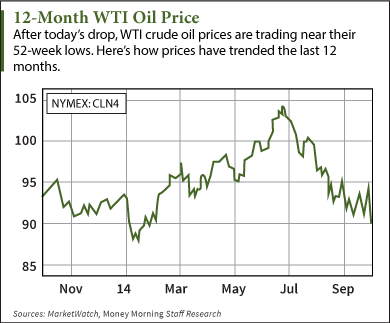

MARKET SNAP: At 6:05 a.m. ET, S&P 500 futures up 0.1%. 10-Year Treasury yield lower at 2.20%. Nymex down 92 cents at $84.82. Gold 0.2% higher at $1233. In Europe, FTSE 100 down 0.5%, DAX down 0.7% and CAC 40 down 0.9%. In Asia, Nikkei 225 down 2.4% and Hang Seng (0011.HK) down 0.4%.

WATCH FOR: September NFIB Small Business Survey (7:30 a.m. Eastern Time): seen 95.9; previously 96.1. Citigroup (C), CSX, Del Frisco’s, Domino's Pizza (DPZ), Intel (INTC), J.B. Hunt Transport (JBHT), Johnson & Johnson (JNJ), Linear Tech (LLTC), Wells Fargo (WFC) and Wolverine World Wide (WWW) are among companies scheduled to report quarterly results.

THE BREAKFAST BRIEFING

A key technical level in the stock market was breached on Monday, ending a years-long streak and making some investors nervous about what lies ahead.

The S&P 500 tumbled below its 200-day moving average for the first time since November 2012, ending the fifth-longest streak in history, according to MKM Partners, and calling into question the stamina of the rally.

Stocks waffled Monday before pushing decisively lower in the final trading hour. The S&P 500 fell 1.7% to 1874, its fifth-straight daily close greater than 1%. Perhaps more importantly, the late-day selloff pushed the S&P 500 well below the 200-day marker, around 1905.

To some, that's a sign of additional weakness ahead.

The 200-day average is a chart line technical analysts use as a guide to define a market's trend. When the S&P 500 starts trading below this level, the market is viewed as entering a longer-term downtrend. The S&P 500 is down 6.8% from last month's record high. The Dow Jones Industrial Average, which also fell below its 200-day average on Monday, is now down 5.5% from its all-time high. Both haven't had a 10% pullback in three years.

"Simply put, it feels like the long-awaited test of the 200-day moving average for stock indices is now not a reason to pick-up bargains, but a reason to sell," said Andrew Wilkinson, chief market analyst at Interactive Brokers. "Contrarians are free to use [a chart] to pinpoint a turning point if they choose. Everyone else is likely to keep on hedging and selling."

History is on Mr. Wilkinson's side.

Since 1928, eight of the S&P 500's nine longest streaks above the 200-day moving average were greeted with additional selling one week after those streaks were snapped, according to MKM Partners. The index averaged a 3% drop in a one-week span after those streaks were breached.

The average one-month and six-month returns after those streaks were also negative.

Investors who focus on fundamentals and corporate profits say they remain composed and are taking the latest chart action with a heavy grain of salt.

"I haven't heard anything that suggests the economic outlook for 2015 has changed a bit," said James Meyer, chief investment officer at Tower Bridge Advisors. "That gives me comfort that the current correction won’t be long lasting."

But a troublesome technical picture over the short-term has prompted some analysts and E*Trade (ETFC)rs to expect further declines in the coming weeks.

"Perhaps there are bigger forces at work and the playbook over the last two years is beginning to change," said Jonathan Krinsky, chief market technician at MKM Partners.

Morning MoneyBeat Daily Factoid: On this date in 1979, hockey legend Wayne Gretzky scored the first goal of his career as a member of the Edmonton Oilers. He would finish his hall-of-fame career with 894 goals.

-By Steven Russolillo; follow him on Twitter @srussolillo.

STOCKS TO WATCH

Advanced Micro Devices (AMD) shares fell sharply in late trading Monday on heavy volume. The stock fell as much as 16%. AMD named a new CEO last week and is expected to post its latest quarterly results on Thursday.

J.P. Morgan Chase (JPM) releases third quarter results early, with earnings of $1.36 a share on sales of $24.2 billion in the third quarter.

Citigroup is expected to report earnings of $1.12 a share on sales of $19.2 billion in the third quarter, based on a FactSet survey of 21 analysts covering the stock.

Wells Fargo is expected to report earnings of $1.02 a share on sales of $21.1 billion in the third quarter, based on a FactSet survey of 24 analysts covering the stock.

Johnson & Johnson is expected to report earnings of $1.44 a share on sales of $18.4 billion in the third quarter, based on a FactSet survey of 17 analysts covering the stock.

MUST READS (LINKS)

J.P. Morgan Returns to Profit: “J.P. Morgan Chase & Co. swung to a third-quarter profit as the bank bounced back from a year-earlier period weighed down by massive legal charges.”

Ebola Response Strains Hospitals: “The challenges specialized centers have encountered with Ebola show the steep learning curve all hospitals are facing.”

Railroad Merger Plan Remains Alive: “Canadian Pacific's proposed merger with CSX is being pushed by perhaps the only railroad boss in favor of consolidation and discussions remain possible.”

Heard on the Street: CSX Deal Hopes Could Run Off the Rails: “If CSX changes its mind and decides to accept Canadian Pacific (CP.T) Railway's overtures, there is still one problem. Any nuptials would face the threat of regulators standing up from the pews and objecting.”

Global Glut Keeps Pressure on Oil Prices: “Crude producers, from corporations to oil-rich nations, are keeping the spigots open, and there is little sign that global demand will rise quickly enough to help erase the overhang in supplies.”

European Stocks Under Renewed Pressure: “Stock markets in Europe took a fresh tumble while German government bonds surged to their strongest level on record, with investors fleeing to the safety of high-grade debt amid further signs that the economic recovery in the eurozone has hit the buffers.”

New Penney CEO Is Strong in Retail Operations: “J.C. Penney chose Marvin Ellison, a retail veteran most recently at Home Depot (HD), as its next CEO, picking an executive who is known for his strong operational skills and giving him a long transitional period to come up to speed.”

Ahead of the Tape: Big Banks Look to Get Back on Track: “Many of the largest U.S. banks may finally be experiencing a reversal of fortune—in a good way.”

Janus Deal Gives Bill Gross an ETF Platform: “Janus Capital said it will buy a provider of exchange-traded funds, a move that some analysts say will provide new hire Bill Gross a platform to launch his own ETF.”

Abigail Johnson Named CEO of Fidelity: “Fidelity Investments has named Abigail "Abby" Johnson chief executive, according to an internal memo sent by the mutual-fund firm Monday.”

Former E*Trade Unit Lays Off Several Employees, Including CEO: “G1 Execution Services LLC laid off several employees, including its CEO, eight months after the company was acquired by Susquehanna International Group LLP, according to people familiar with the matter.”

HLS data by YCharts

HLS data by YCharts

Stephane Jourdain/AFP/Getty Images If you stop by a McDonald's (MCD) and find some franchise owner looking wistfully at you, and then gazing over at a poster for the company's annual Monopoly promotion or the return of the McRib, don't be surprised. Things are tough for franchisees standing under the golden arches, and they're really hoping for something -- anything -- that can reverse the trend of dropping sales. For a fast food company that for a long time could do no wrong , McDonald's is in a not-so-happy place now. In September, the chain announced its worst sales dip since 2003, according to Bloomberg. Between slow demand in the U.S. and health scares over a Chinese meat supplier, same-store sales were down in August 3.2 percent in the U.S. and 7.3 percent in Asia, for an overall 3.7 percent hit. And it's expected that the chain will see another 2.7 percent drop in September, according to the site BurgerBusiness.com. Same-store sales, or sales in locations that have been open more than a year, are a critical measurement in retail. They show how well a company's operations are doing without the distorting factor of new outlets opening. So same-store sales declines are a problem not just for McDonald's, but its franchise owners.

Stephane Jourdain/AFP/Getty Images If you stop by a McDonald's (MCD) and find some franchise owner looking wistfully at you, and then gazing over at a poster for the company's annual Monopoly promotion or the return of the McRib, don't be surprised. Things are tough for franchisees standing under the golden arches, and they're really hoping for something -- anything -- that can reverse the trend of dropping sales. For a fast food company that for a long time could do no wrong , McDonald's is in a not-so-happy place now. In September, the chain announced its worst sales dip since 2003, according to Bloomberg. Between slow demand in the U.S. and health scares over a Chinese meat supplier, same-store sales were down in August 3.2 percent in the U.S. and 7.3 percent in Asia, for an overall 3.7 percent hit. And it's expected that the chain will see another 2.7 percent drop in September, according to the site BurgerBusiness.com. Same-store sales, or sales in locations that have been open more than a year, are a critical measurement in retail. They show how well a company's operations are doing without the distorting factor of new outlets opening. So same-store sales declines are a problem not just for McDonald's, but its franchise owners.

Wave Royalty Free/Design Pics Inc./Alamy This is going to make me sound like an old man, but I'll get it out of the way: I had a paper route in high school. Back in the day when newspapers were prosperous and teenagers could deliver the daily paper on their bikes, I had many paper routes. At one time, I managed three at once: one in the morning and two in the afternoon. I learned a lot of good life skills as a paper boy, and among the most important was that spending a lot isn't always a good thing. Since I didn't have the expenses of adulthood, I was free to blow my earnings on pizza, video games, clothes and anything else that caught my eye. What I didn't have, because I was piddling away my money, was any substantial amount of savings to buy a car or anything else that required more than a week's salary. I don't remember precisely when the realization hit, but when it did, it hit hard: If I ever wanted to be able to make a big purchase, I had to start saving for it. My first major savings goal was to be able to pay for college. My parents had agreed to cover half of my college education, so my goal was to raise the other half. My paper routes helped me start, leading to selling newspapers in front of the local subway station before and after school, and putting Sunday newspapers in news racks around my hometown in the early hours of Sunday mornings. It was a lot of work, and I didn't sleep much for a few years, but it paid off with a good-size savings account when I graduated from high school. Since then I've tried, though I haven't always been successful, in saving for big, planned purchases -- a house, car, vacations and even my daughter's first year of life -- so my wife and I could each afford to take six months off from work to take care of her. Putting money aside for months so we could care for our new baby was the best savings goal. We now have savings accounts that we regularly contribute to for vacations, Christmas and emergencies. Having a savings plan requires thinking ahead about things that will come up anyway. Christmas is every December, and having a savings plan for your holiday spending can make it easier to afford. Saving for a vacation, for example, can take six months to a year. Putting aside money each month isn't the only benefit in thinking ahead about a vacation. It can also give you time to find the best deals and research where you want to go, while knowing you'll have enough money saved to pay for most of the trip before you depart. Saving for a home, auto or any other big expense can take years. But that doesn't mean it should be seen as insurmountable. After putting aside a few hundred dollars each month -- or whatever you can afford -- consider saving a tax rebate or bonus at work. Tips from happy customers, as I learned from my newspaper routes, can add up to substantial savings and more spending money in college. And you can never have enough spending money in college.

Wave Royalty Free/Design Pics Inc./Alamy This is going to make me sound like an old man, but I'll get it out of the way: I had a paper route in high school. Back in the day when newspapers were prosperous and teenagers could deliver the daily paper on their bikes, I had many paper routes. At one time, I managed three at once: one in the morning and two in the afternoon. I learned a lot of good life skills as a paper boy, and among the most important was that spending a lot isn't always a good thing. Since I didn't have the expenses of adulthood, I was free to blow my earnings on pizza, video games, clothes and anything else that caught my eye. What I didn't have, because I was piddling away my money, was any substantial amount of savings to buy a car or anything else that required more than a week's salary. I don't remember precisely when the realization hit, but when it did, it hit hard: If I ever wanted to be able to make a big purchase, I had to start saving for it. My first major savings goal was to be able to pay for college. My parents had agreed to cover half of my college education, so my goal was to raise the other half. My paper routes helped me start, leading to selling newspapers in front of the local subway station before and after school, and putting Sunday newspapers in news racks around my hometown in the early hours of Sunday mornings. It was a lot of work, and I didn't sleep much for a few years, but it paid off with a good-size savings account when I graduated from high school. Since then I've tried, though I haven't always been successful, in saving for big, planned purchases -- a house, car, vacations and even my daughter's first year of life -- so my wife and I could each afford to take six months off from work to take care of her. Putting money aside for months so we could care for our new baby was the best savings goal. We now have savings accounts that we regularly contribute to for vacations, Christmas and emergencies. Having a savings plan requires thinking ahead about things that will come up anyway. Christmas is every December, and having a savings plan for your holiday spending can make it easier to afford. Saving for a vacation, for example, can take six months to a year. Putting aside money each month isn't the only benefit in thinking ahead about a vacation. It can also give you time to find the best deals and research where you want to go, while knowing you'll have enough money saved to pay for most of the trip before you depart. Saving for a home, auto or any other big expense can take years. But that doesn't mean it should be seen as insurmountable. After putting aside a few hundred dollars each month -- or whatever you can afford -- consider saving a tax rebate or bonus at work. Tips from happy customers, as I learned from my newspaper routes, can add up to substantial savings and more spending money in college. And you can never have enough spending money in college.