www.ksl.com Not long ago, Vince was just a regular guy living a regular life until one day, his wife started "staying up late preferring the company of Dave Ramsey" to him. Before he knew it, he found himself conforming his life to Ramsey's gospel as well. And then Vince realized he wanted to buy an acoustic guitar, but that didn't jibe with his Ramsey lifestyle -- unless he sold his guitar amp. And so he posted this hilarious classified ad to sell his amp and lament how Dave Ramsey had ruined his life. As he says in his ad:

www.ksl.com Not long ago, Vince was just a regular guy living a regular life until one day, his wife started "staying up late preferring the company of Dave Ramsey" to him. Before he knew it, he found himself conforming his life to Ramsey's gospel as well. And then Vince realized he wanted to buy an acoustic guitar, but that didn't jibe with his Ramsey lifestyle -- unless he sold his guitar amp. And so he posted this hilarious classified ad to sell his amp and lament how Dave Ramsey had ruined his life. As he says in his ad:

"You see, I could make half a million a year and still not be able to afford a $15 Hello Kitty guitar from Toys R Us, because as long as I have a mortgage, every red cent is consumed by paying off debt or 'responsible saving.' Even when considering an affordable $250 guitar, I feel like I'm stealing from my kids' clothing account (I have four daughters) [...] or the cat account (You read that right -- that excessively obese feline lays around and eats at least $30 worth of cat food per month, but my daughters cherish the fatty. He's like Dom DeLuise with cat hair). The list goes on. "Now just to be clear, I don't blame my wife -- I actually appreciate her level head. It's just one of the things I love about her. And I get it -- we'll be better off in the long run. I'm grateful. Really. But man, I want a guitar now, ya know?"

We got in touch with Vince and asked him more about how Ramsey has affected his life. Are you a fully-devout Dave follower, or are there specific parts of his gospel that you don't believe? "Well, as I've stated, I'm a beginner at best to The Doctrine of Dave, as my wife is the one to have read his books and listen to his radio show. I'm a believer. But, as she's shared with me Dave's teachings, I suppose I have a few tiny issues. My main issue is that I don't view the responsible use of credit cards as a bad thing. As I pay off the balance each month, I build credit, which is something that Dave says is unnecessary -- another nugget of wisdom I call into question. But by and large, I like what Dave has to say." We know Dave Ramsey has ruined your life. But what's the best thing to come out of all of this "ruining"? "I suppose the best thing that's come from this is that it's given my wife and me something concrete that we can be together on regarding finances. We've largely been aligned at a principle level -- you know, avoid debt, live within your means, etc., but Dave's program and his 'baby-steps' have put action to those principles. And this action now serves as our shared financial goals. That's a good thing. Also, I consume less calories in Slurpees. My wife really likes that part." Have you received any interesting emails from people since you posted that ad? Any fellow Dave fans contacted you to commiserate? "Here are a few excerpts from the more interesting messages perfect strangers have sent me: 'I can't buy your amp, but I'd love to mail you an old guitar I don't use. I can't play it, and as my wife also has come to the Ramsey, I feel your pain.' 'While I don't need an amp, I just want to say, from one Dave Ramsey 'victim' to another, I offer you my deepest sympathies.' 'Loved the ad. . . . I'm spreading the word to all my friends who haven't met the evil Mr. Ramsey. Good luck selling the amp, I wish I could buy it!' 'Can my husband and I come over and share with you our debt snowball and how we are securing our future? Are evenings better for you and your wife?' (That one scared me the most.)" So where are you at with selling the amp? "I've sold it! My ad was shared multiple times through Facebook and someone in Orlando, Florida, bought it." Any luck selling your fat cat? "Please. As if. There's no way I'd ever live down selling the beloved heifer. I swear that cat enjoys more affection under my own roof than I do. And he knows it. In fact, a few days after I posted my ad, I woke one morning with difficulty breathing only to find him (and his girth) sitting square on my chest, with his hind-end positioned inches from my face. I think he knew about the ad somehow." Any other final words of wisdom to fellow Dave-commiserators out there? "Do everything you can to support and nurture your most treasured relationships -- and as unromantic as it may sound, having unified financial goals plays a big role in marital harmony. Go for it. Also, if you have a cat, train it from kittenhood to eat small portions." We hear ya, Vince. So maybe Ramsey didn't ruin his life after all. But considering that more than 21,000 people (and counting) have viewed the ad, many can sympathize with his love/hate relationship. And in the end, he sold the amp, which sounds like a win-win to us. More from Joanna & Johnny•Ups and Downs of Retirement Expenses: What Do You Need? •How to Land Posh Hotel Upgrades for $20 •How I Decided to Quit My Job to Be a Stay-at-Home Mom

Alamy While a recent survey by Citi (C) shows that nine out of 10 parents teach their kids about money and 59 percent say they talk to their kids about personal finance, there are still a few financial topics that parents prefer not to discuss. "Our survey findings showed that most parents have begun discussing finances with their children before age 13, and nearly half of respondents said that sensitive financial topics are not off-limits for conversations with their children," says Linda Descano, a personal finance expert with Citi. "However, the topics that most respondents found off-limits were 'the amount of money I make' (with 28 percent believing this was off-limits), 'the amount of savings we have' (27 percent) and 'the amount of debt we have' (26 percent)."

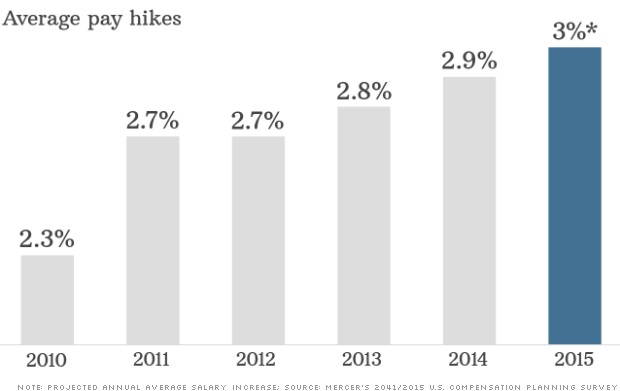

Alamy While a recent survey by Citi (C) shows that nine out of 10 parents teach their kids about money and 59 percent say they talk to their kids about personal finance, there are still a few financial topics that parents prefer not to discuss. "Our survey findings showed that most parents have begun discussing finances with their children before age 13, and nearly half of respondents said that sensitive financial topics are not off-limits for conversations with their children," says Linda Descano, a personal finance expert with Citi. "However, the topics that most respondents found off-limits were 'the amount of money I make' (with 28 percent believing this was off-limits), 'the amount of savings we have' (27 percent) and 'the amount of debt we have' (26 percent)." NEW YORK (CNNMoney) Hiring among U.S. employers may be picking up steam, but worker wages? Not so much.

NEW YORK (CNNMoney) Hiring among U.S. employers may be picking up steam, but worker wages? Not so much.  A look at July's jobs report

A look at July's jobs report  It's less than two years since Standard Chartered paid a fine for breaking U.S. sanctions on Iran. LONDON (CNNMoney) Remember Standard Chartered, the British bank fined twice in 2012 for sanctions busting and money laundering? Well, it seems the bad behavior continues.

It's less than two years since Standard Chartered paid a fine for breaking U.S. sanctions on Iran. LONDON (CNNMoney) Remember Standard Chartered, the British bank fined twice in 2012 for sanctions busting and money laundering? Well, it seems the bad behavior continues.