Thursday, October 31, 2013

Mosaic Intros CropNutrition.com - Analyst Blog

This website is an integral part of Mosaic's CropNutrition initiative. Under this initiative, Mosaic has designed an integrated campaign to educate farmers and retailers about important issues and trends affecting soil fertility. The company hopes that farmers will understand that there are various scientific aspects vital to achieving maximum yield and 60% of yield depends on soil fertility.

Mosaic has used numerous vehicles to spread the expertise and agronomic knowledge that is required for understanding the soil better, growing stronger crops and drive higher yields.

Mosaic has combined its prior crop nutrition resource Back-to-Basics.net's best research and soil fertility resources with new information gathered from its global network of research partners in the CropNutrition.com website. In addition, CropNutrition.com provides research findings and insights from Mosaic's best agronomists.

The website features crop nutrition expertise in forms including dynamic videos, timely and topical blog posts, an Agronomy Resource Center, an interactive periodic table of essential crop nutrients, and an extensive, searchable library.

Mosaic's team of elite agronomists aims to enlighten the farmers and retailers about the impact of a balanced approach to crop nutrition that can have on yield.

Plymouth-based Mosaic, which is among the biggest fertilizer companies on the planet along with Agrium Inc. (AGU), CF Industries Holdings, Inc. (CF) and Potash Corp. of Saskatchewan, Inc.(POT), is a single-source provider of phosphates, potash fertilizers and feed ingredients for the global agriculture industry.

Mosaic, which currently holds a Zacks ! Rank #3 (Hold), will release its fourth-quarter fiscal 2013 results before the market opens on Jul 16.

For LPL, recruiting numbers add up

LPL CEO Mark Casady Bloomberg News

LPL CEO Mark Casady Bloomberg News Recruiting came roaring back in the third quarter for LPL Financial, which added 154 net new registered representatives and advisers for the three-month period ended Sept. 30.

The firm added 40 registered reps from a bank, which LPL declined to identify. The recruiting figures were made public as part of the firm's third-quarter earnings report Wednesday.

The robust quarter brings LPL's 12-month recruiting tally to 393 net new reps and advisers, putting the industry's largest independent broker-dealer in line with its long-stated objective of adding at least 400 net new reps and advisers per year.

Like many of its competitors, LPL's recruiting was in the doldrums over the first half of the year, a period in which it added just 56 net new advisers.

LPL's recruiting efforts have long led the industry and are widely regarded as a bellwether among its competitors, which likewise saw a slowdown in recruiting in the first half.

(See also: LPL puts layoff, outsourcing plan into action)

Overall, LPL reported a solid quarter: Net revenue increased 16.1% compared with the same period a year earlier, reaching $1.05 billion. Net income was $37.6 million, an increase of 9.7% versus the same quarter in 2012. Total assets were $414.7 billion as of Sept. 30, up 11.7% from a year ago. The firm now has 13,563 registered reps and advisers.

With the strong performance of the stock market in the first half, reps and advisers were reluctant to move, chief executive Mark Casady said Wednesday in a conference call with analysts. During that time, advisory firms either were focused on existing clients or getting used to the increased volume and adding staff members to deal with their practices' higher revenue, he said. That slowed down recruiting.

Recruiting got back to normal over the summer, Mr. Casady said.

“In the third quarter, recruiting was from all over,” he said, with reps and advisers leaving banks, credit unions, insurance company-owned broker-dealers, independent broker-dealers and wirehouses to join LPL.

Mr. Casady said that LPL is continuing to study the idea of starting a bank and will have more information regarding that potential line of business in a few months.

Commission revenue jumped 19.3% in the third quarter compared with the 2012 period; that reflected an increase in sales of alternative investments, including nontraded real estate investment trusts, the company said.

Along with several other independent broker-dealers, LPL has drawn scrutiny over the past year for sales of nontraded REITs. In total, six IBDs, including LPL and Securities America Inc., have agr! eed to offer $21.6 million in restitution to clients with regard to violations involving sales of nontraded REITs, and they have paid fines of close to $1.5 million.

(Don't miss: Massachusetts hits five IBDs with $10.75M charge on nontraded REIT sales)

LPL's chief financial officer, Dan Arnold, said in an interview that commissions from nontraded REITs increased as trusts such as Cole Credit Property Trust III became listed companies. As a result, some clients selling those holdings and allocating the money into other nontraded REITs that promise yields of 6% to 7%.

Mr. Arnold added that LPL was seeing potential to add advisers from banks with $30 billion to $60 billion in assets that are looking to outsource broker-dealers business to a third party such as LPL.

“There is a trend towards larger banks exploring outsourcing for economic reasons, and one bank [this past quarter] did deliver 35 to 40 reps,” he said.

Tuesday, October 29, 2013

Can Boeing Reach All-Time Highs?

With shares of Boeing (NYSE:BA) trading around $103, is BA an OUTPERFORM, WAIT AND SEE or STAY AWAY? Let's analyze the stock with the relevant sections of our CHEAT SHEET investing framework:

T = Trends for a Stock’s Movement

Boeing is an aerospace company. It focuses primarily on engineering, information technology, research and development, test and evaluation, technology strategy development, environmental remediation management and intellectual property management. The company operates in five segments: Commercial Airplanes, Boeing Military Aircraft, Network & Space Systems, Global Services & Support, and Boeing Capital Corporation. As a leading provider of aerospace products and services to large corporations, including the United States Government, look for Boeing to continue to advance and develop this space and fuel aerial progress.

T = Technicals on the Stock Chart are Strong

Boeing stock has seen a very powerful surge higher over the last several years. The stock is set to test previous all-time high prices so it may need time to battle out these prices. Analyzing the price trend and its strength can be done using key simple moving averages. What are the key moving averages? The 50-day (pink), 100-day (blue), and 200-day (yellow) simple moving averages. As seen in the daily price chart below, Boeing is trading above its rising key averages which signal neutral to bullish price action in the near-term.

(Source: Thinkorswim)

Taking a look at the implied volatility (red) and implied volatility skew levels of Boeing options may help determine if investors are bullish, neutral, or bearish.

| Implied Volatility (IV) | 30-Day IV Percentile | 90-Day IV Percentile | |

| Boeing Options | 23.98% | 40% | 39% |

What does this mean? This means that investors or traders are buying a significant amount of call and put options contracts, as compared to the last 30 and 90 trading days.

| Put IV Skew | Call IV Skew | |

| July Options | Flat | Average |

| August Options | Flat | Average |

As of today, there is an average demand from call buyers or sellers and low demand by put buyers or high demand by put sellers, all neutral to bullish over the next two months. To summarize, investors are buying a significant amount of call and put option contracts and are leaning neutral to bullish over the next two months.

On the next page, let’s take a look at the earnings and revenue growth rates and the conclusion.

E = Earnings Are Increasing Quarter-Over-Quarter

Rising stock prices are often strongly correlated with rising earnings and revenue growth rates. Also, the last four quarterly earnings announcement reactions help gauge investor sentiment on Boeing’s stock. What do the last four quarterly earnings and revenue growth (Y-O-Y) figures for Boeing look like and more importantly, how did the markets like these numbers?

| 2013 Q1 | 2012 Q4 | 2012 Q3 | 2012 Q2 | |

| Earnings Growth (Y-O-Y) | 18.03% | -30.91% | -7.53% | 1.60% |

| Revenue Growth (Y-O-Y) | -2.53% | 14.05% | 12.87% | 20.93% |

| Earnings Reaction | 3.00% | 1.27% | -0.15% | 2.77% |

Boeing has seen improving earnings and revenue figures over the last four quarters. From these numbers, the markets have generally been happy about Boeing’s recent earnings announcements.

P = Excellent Relative Performance Versus Peers and Sector

How has Boeing stock done relative to its peers, Lockheed Martin (NYSE:LMT), Spirit Aerosystems (NYSE:SPR), Northrop Grumman (NYSE:NOC), and sector?

| Boeing | Lockheed Martin | Spirit Aerosystems | Northrop Grumman | Sector | |

| Year-to-Date Return | 37.28% | 18.03% | 27.64% | 24.37% | 23.96% |

Boeing has been a relative performance leader, year-to-date.

NEW! Discover a new stock idea each week for less than the cost of 1 trade. CLICK HERE for your Weekly Stock Cheat Sheets NOW!Conclusion

Boeing is an aerospace company that provides companies and Governments worldwide with constantly improving aerial technology. The stock has seen a strong move in recent years and is now getting ready to test previous all-time high prices. Over the last four quarters, earnings and revenue figures have shown signs of progress which have kept investors in the company generally happy. Relative to its peers and sector, Boeing has been a year-to-date performance leader. Look for Boeing to continue to OUTPERFORM.

Monday, October 28, 2013

Is Inflation Of 2% Enough For You?

In one of those “what could possibly go wrong with that plan” moments – which are becoming all too frequent these days – the New York Times this weekend reported that there is “growing concern inside and outside the Fed that inflation is not rising fast enough.”

At some level, this is not exactly new thinking. For decades, economists have argued that “price stability” really means inflation of something just slightly over 0%, because it is assumed to be quite hard to get out of a deflationary spiral. In my view, that’s silly, because simply adding a zero to the currency in everyone’s pocket is a guaranteed way to get out of deflation. It may be that since nudging inflation higher is harder than kicking it higher, the costs of mild deflation are higher than the costs of mild inflation, but I think the jury is out on that question since it isn’t something we have ever experienced. But in any event, this is the reason that inflation in the neighborhood of 2%, rather than 0%, has been the Fed’s implicit or explicit target for a long time.

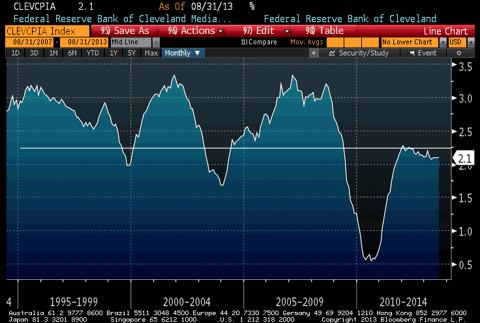

To the extent that discussion stays academic, it’s not worrisome. Navel-gazing is an occupational hazard of being a professional economist, after all. But now, there are louder and more frequent voices arguing that 2% is too low a target. To see how urgent a problem this is, I submit the following chart, which shows median CPI, along with a horizontal line at 2.25% (roughly equivalent to a 2% target on PCE). Wow, I can see the reason for panic. We are nearly 0.2% below that! And we got within 0.6% of deflation in 2010, in the aftermath of the worst credit crisis in almost 100 years.

(click to enlarge) I am all for the idea that mild inflation serves to lubricate the gears of commerce, but we should remember that when the CFO of Costco (COST) says he likes rising inflation because i! n that circumstance “the retailer is generally able to expand its profit margins,” that’s good for the equity market perhaps but not as good for the consumer!

I am all for the idea that mild inflation serves to lubricate the gears of commerce, but we should remember that when the CFO of Costco (COST) says he likes rising inflation because i! n that circumstance “the retailer is generally able to expand its profit margins,” that’s good for the equity market perhaps but not as good for the consumer!

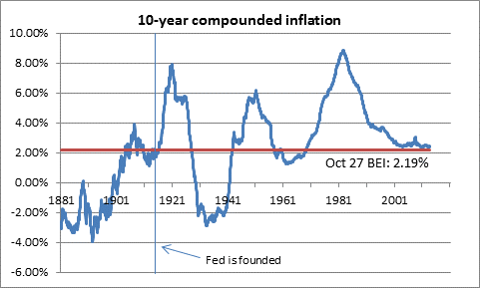

It always amazes me how sketchy is the understanding of inflation in a capital markets context by members of the Fed. In the aforementioned article, Chicago Fed President Evans is quoted, saying, “If inflation is lower than expected, then debt financing is more burdensome than borrowers expected. Problems of debt overhang become that much worse for the economy.” This is absolutely true, but almost completely irrelevant in the current context. Inflation has been lower than a priori expectations since about 1980, which is why a long-nominal-bond position has routinely outperformed inflation. But currently, as the chart below illustrates, 10-year inflation breakevens are at 2.19%. Fully 72% of all 10-year periods since 1914 have seen compounded inflation above that level.

(click to enlarge)

Ten-year inflation swaps, a better measure of inflation expectations, are at 2.52%, which still doesn’t sound like a horrible bet for borrowers. If inflation comes in above 2.52%, the borrower of 10-year fixed-rate money wins; if it comes in below 2.52%, the borrower loses. This is one reason that it is so rare to see corporations issue inflation-indexed debt… they like that bet.

Finally, the article explains that higher inflation allows workers to get higher wages, and gives the example of teachers in Anchorage, Alaska, who just agreed to a contract giving them 1% pay increases for each of the next three years. Since inflation is likely to be above that, the article says, they will be probably receiving a pay cut in real terms. This is absolutely true. (It is also the exact opposite position of the debtor, in that the teachers will do better in real terms if deflation actually happened. Sometimes I ju! st wish t! he authors of these articles would be consistent.) But this circumstance certainly isn’t helped by inflation; since wage increases tend to trail inflation, real wages tend to lag in inflationary upticks.

None of this represents deep insight from this author. It merely represents that I have at least a rudimentary understanding of how inflation works, and a respect for the damage inflation can cause to economies, workers, and savers. The fact that this is increasingly rare these days is probably cyclical, and unfortunately is probably a minimum condition for setting up this next inflation debacle. In that context, and with more Federal Reserve economists openly musing about needing to target higher inflation, does 2.19% breakeven sound like a bad deal?

Source: Is Inflation Of 2% Enough For You?Sunday, October 27, 2013

Small-Caps Double Dow in Signal Economy Is Gaining Speed

The smallest stocks are rallying almost twice as fast as bigger companies in the U.S., a bullish economic signal from businesses whose profits are most dependent on domestic demand.

Shares of companies from Rite Aid Corp. to Teledyne Technologies Inc. in the Russell 2000 Index (RTY) have advanced 32 percent in 2013, compared with 19 percent for the Dow Jones Industrial Average. The spread is the widest for any year since 2003, according to data compiled by Bloomberg. Three of the last four times small-caps outperformed by this much, the economy grew faster the next year and stocks stayed in a bull market for another year or more.

Gains in smaller companies that are more dependent on U.S. growth show investors are betting the world's largest economy will pick up even after jobs growth slowed and the government shutdown weighed on gross domestic product. Smaller firms are surpassing analyst earnings estimates by more than Dow companies and are forecast to grow faster next year.

"If you're focused on the U.S., and the U.S. is performing very well, then of course your revenues and earnings are going to be much better," Kully Samra of Charles Schwab Corp., which has $2.15 trillion of assets globally, said by phone Oct. 24 from London. "Other regions are at different stages of dealing with structural issues, and the U.S. has already dealt with them."

The average company in the Russell 2000 gets 84 percent of its sales from the U.S. and is valued at $972 million, compared with 55 percent and $152 billion for the Dow (INDU), data compiled by Bloomberg show.

Third GainThe Standard & Poor's 500 Index climbed 0.9 percent last week to 1,759.77, the third straight advance after a weaker-than-forecast jobs report spurred speculation the Federal Reserve will maintain stimulus. More than $2.3 billion went into exchange-traded funds that invest in U.S. equities Oct. 21 through Oct. 24. The iShares Russell 2000 ETF attracted almost $500 million, the second-most among about 500 funds, according to Bloomberg data.

Rite Aid, the third-largest U.S. drugstore chain, raised its profit forecast last month because of increasing sales at remodeled stores. The Camp Hill, Pennsylvania-based company gets 100 percent of its sales from the U.S. and has rallied 276 percent in 2013.

Teledyne Technologies (TDY), which gets 80 percent of its revenue from the U.S., raised its 2013 per-share earnings projections last week. The Thousand Oaks, California-based aerospace and defense electronics provider, up 39 percent for the year, exceeded analyst projections by 8.1 percent last quarter, data compiled by Bloomberg show.

Orbitz RallyOrbitz Worldwide Inc. (OWW) in August projected third-quarter revenue would be higher than analysts estimated. Orbitz, which gets 72 percent of sales from the U.S., has rallied 219 percent in 2013 and beaten estimates the last two quarters. The company is scheduled to report results for the third quarter on Nov. 5.

Small-caps have outperformed since the bull market began in March 2009, climbing 226 percent, compared with 138 percent for large-caps. Furniture store Pier 1 Imports Inc. (PIR) and Dana Holding Corp., a maker of car and truck axles, led the Russell 2000, advancing more than 11,000 percent each. The biggest gainers in the Dow during the period were American Express Co. with a 676 percent gain and Walt Disney Co., which rose 344 percent.

Accelerating RallyThe advance in small companies has accelerated in the last four months, with the Russell 2000 rising 14 percent since June 30 compared with 4.4 percent in the Dow industrials. The gap is the biggest for any similar period since 1997, according to data compiled by Bloomberg.

"The main driver of small-caps is the cyclicality of the market," Patrick Moonen, who helps oversee about $240 billion as senior strategist at ING Investment Management in The Hague, said by telephone. "What are the economic prospects and how are risk aversion or risk appetite evolving? Both factors were clear tailwinds for small-caps so far this year."

Smaller companies usually climb faster at the start of a bull market, making them a proxy for future economic activity. The Russell 2000 was up 71 percent in the first six months of the 2009 rally, compared with a 46 percent advance in the Dow. This year's outperformance is occurring almost five years after stocks started rallying, signaling the economic recovery will accelerate from what has been slowest rate since World War II.

Economic ProjectionsU.S. GDP will increase at a 2.4 percent annual pace this quarter and reach 3 percent a year from now, economist estimates compiled by Bloomberg show. This month's budget impasse will spur Fed policy makers to wait until March to scale back the $85 billion of monthly bond purchases, a Bloomberg survey showed this month.

"We have a window of three to four months where we have improving fundamentals and low or no risk of tapering," Moonen said. "We are in a sweet spot in that we don't see any major hurdles before the end of the year now that the U.S. fiscal situation is out of the way."

Russell 2000 companies are beating analyst earnings estimates by 11 percent, more than twice the rate for companies in the Dow, according to data compiled by Bloomberg. Results for bigger companies fell short of projections in the second quarter, as the smaller companies surpassed forecasts. Analysts say small companies will boost profits at more than four times the pace of larger firms next year.

High ValuationsThose projections are too optimistic and valuations will get too high as brokers lower their profit predictions, according to Steven DeSanctis, Bank of America Corp.'s strategist for small-cap equities in New York. The Russell 2000's price-earnings ratio increased 52 percent this year to 27.5 times estimated operating earnings, compared with 14.7 for the Dow, according to data compiled by Bloomberg.

"It seems a little too optimistic," Desanctis said by phone. He predicts the Russell 2000 of smaller companies will end this year at 1,100, or 1.6 percent lower than the close on Oct. 25. "At the start of the year, valuations were attractive. Not so much today."

Earnings and economic reports don't justify small-cap prices and shares of larger companies won't necessarily follow the Russell 2000, according to Lawrence Creatura, a Rochester, New York-based fund manager at Federated Investors Inc., which oversees about $364 billion.

"The arrows are not pointing in the direction that suggests that large-cap stocks have to follow their small-cap brethren," he said by phone on Oct. 23. "Based on the earnings that we have so far, it appears that economic growth is not as robust as what we hoped for at the beginning of the year."

Past IndicatorSmall-cap gains of this size have proven prescient in the past. They preceded faster economic growth and a broader stock market advance in 2003 and 1991, and coincided with them in 1979. The Russell 2000's outperformance in 2003 was at the start of the last equity bull market, when the S&P 500 more than doubled from October 2002 through October 2007. GDP expanded at the fastest rate in four years in 2004.

In 1991, small-caps were up 36 percent through Oct. 25, more than twice larger stocks, at the start of the largest bull market on record. The S&P 500 gained more than 300 percent from 1990 through 1998 and the economy grew at an average of 3.5 percent per year throughout the decade.

"Historically the trend has been for the small-caps to hand the baton off to the large-caps," Donald Selkin, who helps manage about $3 billion as the New York-based chief market strategist at National Securities Corp.

Business ConfidenceWhile confidence among U.S. small businesses slipped in September, it has hovered near a one-year high the last five months. The National Federation of Independent Business's optimism index rose to 94.4 in May, the highest in a year, from 88 in December, according to data based on a survey of more than 770 small-business owners. The number of firms projecting sales will increase and saying it's a good time to expand rose from August.

Analysts predict earnings at International Business Machines Corp. (IBM), which gets more than half its sales from abroad, will climb 10 percent this year, the slowest since 2004. Shares have slumped 7.7 percent in 2013. Caterpillar Inc., where more than 60 percent of sales is from overseas, cut its 2013 revenue forecast last week. The biggest maker of construction and mining equipment is down 5.4 percent in 2013.

"If you think the U.S. is recovering, then small-caps tend to be more domestically oriented than large-caps," Frances Hudson, an Edinburgh-based strategist at Standard Life Investments Ltd., which oversees about $278 billion, said by phone. "Small-caps are more growth-oriented."

Saturday, October 26, 2013

Jim Cramer's Top Stock Picks: AAPL PPG ETN WLL AMZN

Search Jim Cramer's "Mad Money" trading recommendations using our exclusive "Mad Money" Stock Screener.

NEW YORK (TheStreet) -- Here are some of the hot stocks Jim Cramer talked about on Friday's "Mad Money" on CNBC:

AAPL data by YCharts

AAPL data by YCharts

Apple (AAPL): Cramer said he expects to see increased gross margins from Apple when the company reports next Monday.

PPG data by YCharts

PPG data by YCharts

PPG (PPG): Cramer said this global chemical and coatings manufacturer remains best in show.

ETN data by YCharts

ETN data by YCharts

Eaton (ETN): The world's economy is starting to look a little brighter, said Eaton's CEO, and that made Cramer once again recommend this electrical giant.

WLL data by YCharts

WLL data by YCharts

Whiting Petroleum (WLL): Need another reason to invest in the American oil revolution? How about Whiting's 20-cents-a-share earnings beat on a 56% rise in revenue?

AMZN data by YCharts

AMZN data by YCharts

Amazon.com (AMZN): Cramer congratulated Amazon for another job well done and told the skeptics it's time to move on.

To read a full recap of "Mad Money" on CNBC, click here.

To sign up for Jim Cramer's free Booyah! newsletter with all of his latest articles and videos please click here. To watch replays of Cramer's video segments, visit the Mad Money page on CNBC. -- Written by Scott Rutt in Washington, D.C. To email Scott about this article, click here: Scott Rutt Follow Scott on Twitter @ScottRutt or get updates on Facebook, ScottRuttDC

At the time of publication, Cramer's Action Alerts PLUS had a position in AAPL and ETN. Jim Cramer, host of the CNBC television program "Mad Money," is a Markets Commentator for TheStreet.com, Inc., and CNBC, and a director and co-founder of TheStreet.com. All opinions expressed by Mr. Cramer on "Mad Money" are his own and do not reflect the opinions of TheStreet.com or its affiliates, or CNBC, NBC Universal or their parent company or affiliates. Mr. Cramer's opinions are based upon information he considers to be reliable, but neither TheStreet.com, nor CNBC, nor either of their affiliates and/or subsidiaries warrant its completeness or accuracy, and it should not be relied upon as such. Mr. Cramer's statements are based on his opinions at the time statements are made, and are subject to change without notice. No part of Mr. Cramer's compensation from CNBC or TheStreet.com is related to the specific opinions expressed by him on "Mad Money." None of the information contained in "Mad Money" constitutes a recommendation by Mr. Cramer, TheStreet.com or CNBC that any particular security, portfolio of securities, transaction, or investment strategy is suitable for any specific person. You must make your own independent decisions regarding any security, portfolio of securities, transaction, or investment strategy mentioned on the program. Mr. Cramer's past results are not necessarily indicative of future performance. Neither Mr. Cramer, nor TheStreet.com, nor CNBC guarantees any specific outcome or profit, and you should be aware of the real risk of loss in following any strategy or investments discussed on the program. The strategy or investments discussed may fluctuate in price or value and you may get back less than you invested. Before acting on any information contained in the program, you should consider whether it is suitable for your particular circumstances and strongly consider seeking advice from your own financial or investment adviser. Some of the stocks mentioned by Mr. Cramer on "Mad Money" are held in Mr. Cramer's Action Alerts PLUS Portfolio. When that is the case, appropriate disclosure is made on the program and in the "Mad Money" recap available on TheStreet.com. The Action Alerts PLUS Portfolio contains all of Mr. Cramer's personal investments in publicly-traded equity securities only, and does not include any mutual fund holdings or other institutionally managed assets, private equity investments, or his holdings in TheStreet.com, Inc. Since March 2005, the Action Alerts PLUS Portfolio has been held by a Trust, the realized profits from which have been pledged to charity. Mr. Cramer retains full investment discretion with respect to all securities contained in the Trust. Mr. Cramer is subject to certain trading restrictions, and must hold all securities in the Action Alerts PLUS Portfolio for at least one month, and is not permitted to buy or sell any security he has spoken about on television or on his radio program for five days following the broadcast.Best Bank Companies To Own In Right Now

Emerging stocks capped the biggest monthly slump in a year as Brazilian equities tumbled after policy makers raised the benchmark interest-rate more than forecast. Indian shares plunged on bets inflation may rise.

Brazil�� Ibovespa (IBOV) fell to a six-week low, while the real slid to its weakest level in four years, spurring central bank intervention. Housing Development Finance Corp. drove India�� S&P BSE Sensex down, while the rupee completed its worst month in a year. OAO Lukoil (LKOH), Russia�� second-largest oil producer, slipped 2.3 percent as crude slumped.

The MSCI Emerging Markets Index lost 0.7 percent to 1,008.88, extending its monthly drop to 2.9 percent. Brazil�� central bank raised the benchmark interest-rate by a half-percentage point to 8 percent, surprising 38 of 57 economists surveyed by Bloomberg. India�� economy expanded less than 5 percent for a second straight quarter. The S&P GSCI gauge of commodities slumped a third day.

��lobal growth continues to decelerate,��said Chad Morganlander, a Florham Park, New Jersey-based fund manager at Stifel Nicolaus & Co., which oversees about $130 billion. He spoke in a telephone interview today. ��hat has put the brakes in emerging markets.��

Best Bank Companies To Own In Right Now: Morgan Stanley(MS)

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals worldwide. It operates in three segments: Institutional Securities, Global Wealth Management Group, and Asset Management. The Institutional Securities segment offers financial advisory services on mergers and acquisitions, divestitures, joint ventures, corporate restructurings, recapitalizations, spin-offs, exchange offers, and leveraged buyouts and takeover defenses, as well as shareholder relations, capital raising, corporate lending, and investments. This segment also engages in sales, trading, financing, and market-making activities, including equity trading, commodities, and interest rates, credit, and currencies, as well as financing services, such as prime brokerage, consolidated clearance, settlement, custody, financing, and portfolio reporting services. The Global Wealth Management Group segment provide s brokerage and investment advisory services covering various investment alternatives comprising equities, options, futures, foreign currencies, precious metals, fixed income securities, mutual funds, structured products, alternative investments, unit investment trusts, managed futures, separately managed accounts, and mutual fund asset allocation programs; education savings programs, financial and wealth planning services, and annuity and insurance products; credit and other lending products; cash management services; retirement services; and trust and fiduciary services. The Asset Management segment offers products and services in equity, fixed income, and alternative investments, such as hedge funds, fund of funds, real estate, private equity, and infrastructure to institutional and retail clients through proprietary and third party distribution channels. This segment also involves in investment and merchant banking activities. The company was founded in 1935 and is headq uartered in New York.

Advisors' Opinion:- [By Chad Fraser]

The financial gains all come down to two companies, according to FactSet: Bank of America and Morgan Stanley (NYSE: MS), which are up against weak comparisons from a year ago. Set those two aside, and you’re looking at a 0.6% earnings contraction for the sector.

- [By Amanda Alix]

With employment up 11% from the dark days of 2008, American banks are scarfing up talented employees from the streamlining Brits. The cream of the crop�seems to be hailing from Royal Bank of Scotland (NYSE: RBS ) , from which B of A Merrill Lynch, Citi, and Morgan Stanley (NYSE: MS ) have all appropriated former operatives.

- [By Jon C. Ogg]

Moody’s signaled that the four on review for downgrade are Goldman Sachs Group Inc. (NYSE: GS)�and Morgan Stanley (NYSE: MS), both of which are bank holding companies with no retail banking operations, as well as J.P. Morgan Chase & Co. (NYSE: JPM)�and Wells Fargo & Co. (NYSE: WFC).

- [By Greg Madison]

But the offering was beset by... nearly everything that could go wrong with an IPO. The exchange suffered a computer malfunction that misplaced somewhere between $10 and $20 million worth of share orders. There were allegations that underwriter Morgan Stanley (NYSE: MS) offered too many shares at too high a price.

Best Bank Companies To Own In Right Now: Royal Bank Of Canada(RY)

Royal Bank of Canada provides personal and commercial banking, wealth management services, insurance, corporate and investment banking, and transaction processing services under the RBC name worldwide. Its Canadian Banking segment offers personal financial services, business financial services, and cards and payment solutions. The company?s Wealth Management segment provides wealth and asset management, and estate and trust services to affluent and high net worth clients through distributors, as well as directly to institutional and individual clients in Canada, the United States, Europe, Asia, and Latin America. Its Insurance segment provides various life and health insurance, including universal life, accidental death and critical illness protection, disability, long-term care insurance, and group benefits; and property and casualty insurance comprising home, auto, and travel insurance, as well as wealth accumulation solutions; and reinsurance products through retail ins urance branches, call centers, independent insurance advisors and travel agencies, financial institutions, and career sales force. The company?s International Banking segment offers various financial products and services to individuals, business clients, and public institutions in the U.S. and Caribbean. This segment also provides global custody, fund and pension administration, securities lending, shareholder services, analytics, and other related services to institutional investors. Royal Bank of Canada?s Capital Markets segment engages in the trading and distribution of fixed income, foreign exchange, equities, commodities, and derivative products for institutional, public sector, and corporate clients; and involves in investment banking, debt and equity origination, advisory services, corporate lending, private equity, and client securitization businesses. The company was founded in 1864 and is headquartered in Toronto, Canada.

Advisors' Opinion:- [By Eric Lam]

Canadian stocks rose for a fourth day, extending a two-year high, as Royal Bank (RY) of Canada soared to a record close and energy producers surged on accelerating economic growth in China.

- [By Charles Santerre]

I do feel sorry for analysts. It's a difficult profession to predict the future. After reading RBC's (RY) opinion on Nokia's (NOK) current quarter, I was not pleased. As a Nokia shareholder, I was interested in poking some holes into the piece written by Mark Sue. Since the analysis is only available to RBC investment account holders, I cannot provide a link that would enable you to read the whole document, but I will quote from some passages.

Hot Energy Companies To Invest In Right Now: First Horizon National Corp (FHN)

First Horizon National Corporation (FHN), incorporated in 1968, is a bank holding company. The Company provides financial services through its subsidiary, First Tennessee Bank National Association (the Bank), and its subsidiaries. The Company�� two brands First Tennessee and FTN Financial provide customers with a range of products and services. First Tennessee provides retail and commercial banking services throughout Tennessee. FTN Financial (FTNF) is engaged in fixed income sales, trading, and strategies for institutional clients in the United States and abroad. FHN has four operating business segments: regional banking, capital markets, corporate, and non-strategic. As of December 31, 2011, the Bank had $16.4 billion in total deposits and $16 billion in total net loans. As of December 31, 2011, the Company�� subsidiaries had over 200 business locations in 17 the United States states, Hong Kong, and Tokyo, excluding off-premises automated teller machines (ATMs). As of December 31, 2011, the Bank had 183 branch locations in four states, which include 172 branches in metropolitan areas of Tennessee; two branches in northwestern Georgia; seven branches in northwestern Mississippi, and two branches in North Carolina. As of December 31, 2011, FTN Financial products and services were offered through 18 offices in total, including 16 offices in 14 states plus an office in each of Hong Kong and Tokyo.

The regional banking segment offers financial products and services, including traditional lending and deposit taking, to retail and commercial customers in Tennessee and surrounding markets. Regional banking provides investments, financial planning, trust services and asset management, credit card, cash management, and first lien mortgage originations within the Tennessee footprint. In addition, the regional banking segment includes correspondent banking, which provides credit, depository, and other banking related services to other financial institutions.

The capital markets se! gment consists of fixed income sales, trading, and strategies for institutional clients in the United States and abroad, as well as loan sales, portfolio advisory, and derivative sales. The corporate segment consists of gains on the extinguishment of debt, unallocated corporate expenses, expense on subordinated debt issuances and preferred stock, bank-owned life insurance, unallocated interest income associated with excess equity, net impact of raising incremental capital, revenue and expense associated with deferred compensation plans, funds management, low income housing investment activities, and charges related to restructuring, repositioning, and efficiency. The non-strategic segment consists of the wind-down national consumer lending activities, legacy mortgage banking elements, including servicing fees, and the associated ancillary revenues and expenses related to these businesses. Non-strategic also includes the wind-down trust preferred loan portfolio and exited businesses along with the associated restructuring, repositioning, and efficiency charges.

As of December 31, 2011, the Company provided services through its subsidiaries, which include general banking services for consumers, businesses, financial institutions, and governments; through FTN Financial fixed income sales and trading, underwriting of bank, loan sales, advisory services and derivative sales; discount brokerage and full-service brokerage; correspondent banking; transaction processing, such as nationwide check clearing services and remittance processing; trust, fiduciary, and agency services; credit card products; equipment finance; investment and financial advisory services; mutual fund sales as agent; retail insurance sales as agent, and mortgage banking services.

As of December 31, 2011, the commercial, financial, and industrial (C&I) portfolio was eight billion dollars, and is consisted of loans used for general business purposes, and consisted of relationship customers in Tennessee and certain n! eighborin! g states, which are managed within the regional bank. Products include working capital lines of credit, term loan financing of owner-occupied real estate and fixed assets, and trade credit enhancement through letters of credit. As of December 31, 2011, the unpaid principal balance (UPB) of trust preferred loans totaled $447.2 million with the UPB of other bank-related loans totaling approximately $161.8 million. The commercial real estate portfolio includes both financings for commercial construction and non-construction loans. This portfolio is segregated between income commercial real estate (CRE) loans which contain loans, lines, and letters of credit to commercial real estate developers for the construction and mini- permanent financing of income-producing real estate, and residential CRE loans. The residential CRE portfolio includes loans to residential builders and developers for the purpose of constructing single-family detached homes, condominiums, and town homes. As of December 31, 2011, the residential CRE portfolio was $.1 billion. As of December 31, 2011, the consumer real estate portfolio was $5.3 billion, and is composed of home equity lines and installment loans. As of December 31, 2011, the credit card and other portfolios were $.3 billion, and primarily include credit card receivables, automobile loans, and over-the-counter (OTC) construction loans and other consumer related credits.

FHN�� investment portfolio consists of debt securities, including government agency issued mortgage-backed securities (MBS) and government agency issued collateralized mortgage obligations (CMO). During the year ended December 31, 2011, Government agency issued MBS and CMO, and other agencies averaged $2.9 billion. During 2011, the United States treasury securities and municipal bonds averaged $79.5 million. During 2011, investments in equity securities averaged $222.3 million.

During 2011, short-term funds (certificates of deposit greater than $100,000, federal funds purchased (! FFP), sec! urities sold under agreements to repurchase, trading liabilities, and other short-term borrowings) averaged $3.6 billion. During 2011, other borrowings increased to $.3 billion. Term borrowings include senior and subordinated borrowings and advances with original maturities greater than one year. During 2011, average term borrowings averaged $2.6 billion.

The Company competes with Regions Bank, SunTrust Bank, Wells Fargo Bank N.A., Bank of America N.A., and Pinnacle National Bank.

Advisors' Opinion:- [By Eric Volkman]

After the close of trading Friday, the S&P 500 will include Pfizer spinoff Zoetis (NYSE: ZTS ) . The stock replaces First Horizon National (NYSE: FHN ) , which is to find a new home on the S&P MidCap 400.

- [By Sean Williams]

Finally, regional bank First Horizon National (NYSE: FHN ) , which has banking branches throughout Tennessee, added 4.2% just a day after paying shareholders a $0.05 quarterly dividend. Like Genuine Parts, there is no company specific news driving First Horizon higher, but the prospect for a higher net interest margin because of higher interest rates is certainly adding a boost to banks like First Horizon that rely on traditional loan and deposit growth. But as my Foolish colleague John Maxfield recently pointed out, you may want to keep your expectations for First Horizon tempered in the interim.

Best Bank Companies To Own In Right Now: Australia and New Zealand Banking Group Ltd (ANZ)

Australia and New Zealand Banking Group Limited (ANZ) provides a range of banking and financial products and services to retail, small business, corporate and institutional clients. The Company conducts its operations in Australia, New Zealand and the Asia Pacific region. It also operates in a range of other countries, including the United Kingdom and the United States. The Company operates on a divisional structure with Australia, International and Institutional Banking (IIB), New Zealand, and Global Wealth and Private Banking. As of September 30, 2012, the Company had 1,337 branches and other points of representation worldwide, excluding automatic teller machines (ATMs). In September 2012, it sold its remaining shareholding in Visa Inc. Advisors' Opinion:- [By Adam Haigh]

Australia & New Zealand Banking Group Ltd. (ANZ) sank 3 percent after Australia�� third-largest bank by market value forecast interest margins will keep dropping. Hyundai Merchant Marine Co. jumped 6.9 percent in Seoul after North Korea and South Korea agreed to reopen the Gaeseong industrial complex. Chinese stock exchange officials are investigating a spike in the Shanghai Composite Index, which soared from a loss of as much as 1 percent to a gain of 5.6 percent in two minutes. Everbright Securities Co. said it experienced a trading error.

- [By Weiyi Lim]

The funds lured a net $25.9 billion in the period, Wei Liang Chang, a foreign-exchange strategist at Australia & New Zealand Banking Group Ltd. (ANZ), said by phone from Singapore today, citing data from EPFR Global. Developed markets posted $24.3 billion of inflows, while emerging-nation funds drew $1.6 billion, according to Chang.

Best Bank Companies To Own In Right Now: Banco Bradesco SA (BBD)

Banco Bradesco S.A. (the Bank), incorporated on November 5, 1943, is commercial bank. The Bank offers a range of banking and financial products and services in Brazil and abroad to individuals, large, midsized and small companies and local and international corporations and institutions. It operates in two segments: the banking, and the insurance, pension and capitalization bonds. Its products and services encompass banking operations, such as loans and advances and deposittaking, credit card issuance, purchasing consortiums, insurance, leasing, payment collection and processing, pension plans, asset management and brokerage services. The main services it offers through Bradesco Expresso are receipt and submission of account applications; receipt and submission of account applications; Social Security National Service (INSS) benefit payments; checking and savings account deposits, and receipt of consumption bills, bank charges and taxes. In May, 2011, the Bank acquired Banco do Estado do Rio de Janeiro S.A. (BERJ).

Banking

The Banking segment includes deposit-taking with clients, including checking accounts, savings accounts and time deposits; loans and advances (individuals and companies, real estate financing, microcredit, onlending BNDES funds, rural credit, leasing, among others); credit cards, debit cards and pre-paid cards; management of receipts and payments; asset management; services related to capital markets and investment banking activities; intermediation and trading services; custody, depositary and controllership services; international banking services, and purchasing consortiums.

The Bank offers a variety of deposit products and services to our customers through its branches, including Non-interest bearing checking accounts, such as Easy Account, Click Account, Academic Account and Cell Phone Bonus Account; traditional savings accounts; time deposits, and deposits from financial institutions. As of December 31, 2011, it had 43.4 million savings a! ccounts. It offers its customers certain additional services, such as identified deposits and real-time banking transfers. Its loans and advances to customers, consumer credit, corporate and agricultural-sector loans, totaled R$263.5 billion as of December 31, 2011.

The Bank�� loan portfolio consists of short-term loans, vehicle financings and overdraft loans on checking accounts. It also provides revolving credit facilities and traditional term loans. As of December 31, 2011, it had outstanding advances, vehicle financings, consumer loans and revolving credit totaling R$58.0 billion, or 22.0% of its portfolio of loans and advances. Banco Bradesco Financiamentos (Bradesco Financiamentos) offers direct-to-consumer credit and leasing for the acquisition of vehicles and payroll-deductible loans to the public and private sectors 'in Brazil. Supported by BF Promotora de Vendas Ltda. (BF Promotora), and using the Bradesco Financiamentos brand, the Bank operates through its network of correspondents in Brazil, consisting of retailers and dealers selling light vehicles, trucks and motorcycles, to offer financing and/or leasing for vehicles. Through Bradesco Promotora brand, it offer payroll-deductible loans to social security retirees and pensioners, public-sector employees, military personnel and private-sector companies sponsoring plans, and other aggregated products (insurance, capitalization bonds, cards, purchasing consortiums, and others).

As of December 31, 2011, the Bank had 63,156 outstanding real estate loans. As of December 31, 2011, the aggregate outstanding amount of its real estate loans amounted to R$15.9 billion, representing 6% of its portfolio of loans and advances. As of December 31, 2011, it had 69,491 microcredit loans outstanding, totaling R$62.8 million. Its BNDES onlending portfolio totaled R$35.4 billion as of December 31, 2011.

The Bank provides traditional loans for the ongoing needs of its corporate customers. It had R$85.8 billion of outstand! ing other! local commercial loans, accounting for 32.5% of its portfolio of loans and advances as of December 31, 2011. It offers a range of loans to its Brazilian corporate customers, including short-term loans of 29 days or less; guaranteed checking accounts and corporate overdraft loans; discounting trade receivables, promissory notes, checks, credit card and supplier receivables, and a number of other receivables; financing for purchase and sale of goods and services; corporate real estate financing, and investment lines for acquisition of assets and machinery. As of December 31, 2011, the Bank had R$11 billion in outstanding rural loans, representing 4.2% of its portfolio of loans and advances. The Bank conducts its leasing operations through its primary leasing subsidiary, Bradesco Leasing and also through Bradesco Financiamentos.

The Bank offers electronic solutions for receipt and payment management solutions, which include collection and payment services and online resource management enabling its customers to pay suppliers, salaries, and taxes and other levies to governmental or public entities. The global cash management concept provides solutions for multinationals in Brazil and/or domestic companies operating abroad. It manages third-party assets through mutual funds; individual and corporate investment portfolios; pension funds, including assets guaranteeing the technical provisions of Bradesco Vida e Previdencia, and insurance companies, including assets guaranteeing the technical provisions of Bradesco Seguros.

The Bank�� subsidiaries Bradesco S.A. CTVM and Agora S.A. CTVM (or Bradesco Corretora and Agora Corretora, respectively) trade stocks, options, stock lending, public offerings and forwards. They also offer a range of products, such as Brazilian government securities (under the Tesouro Direto program), BM&F trading, investor clubs and investment funds.

The Bank offers a range of international services, such as foreign exchange transactions, foreign tr! ade finan! ce, lines of credit and banking. As of December 31, 2011, its international banking services included New York City, a branch and Bradesco Securities Inc., its subsidiary brokerage firm, or Bradesco Securities United States, and its subsidiary Bradesco North America LLC, or Bradesco North America; London, Bradesco Securities U.K., its subsidiary, or Bradesco Securities U.K.; Cayman Islands, two Bradesco branches and its subsidiary, Cidade Capital Markets Ltd., or Cidade Capital Markets; Argentina, Banco Bradesco Argentina S.A., its subsidiary, or Bradesco Argentina; Banco Bradesco Luxemburgo S.A. its subsidiary, or Bradesco Europe; Japan, Bradesco Services Co. Ltd., its subsidiary, or Bradesco Services Japan; in Hong Kong, its subsidiary Bradesco Trade Services Ltd, or Bradesco Trade, and in Mexico, its subsidiary Ibi Services, Sociedad de Responsabilidad Limitada, or Ibi Mexico.

The Bank�� Brazilian foreign-trade related business consists of export and import finance. In addition to import and export finance, its customers have access to a range of services and foreign exchange products, such as purchasing and selling travelers checks and foreign currency paper money; cross border money transfers; advance payment for exports; accounts abroad in foreign currency; cash holding in other countries; collecting import and export receivables; repaid cards with foreign currency (individual), and structured foreign currency transactions through its foreign units.

Insurance, pension plans and capitalization bonds

The Bank offers insurance products through a number of different entities, which it refers to collectively as Grupo Bradesco Seguros. It offers life, personal accident and random events insurance through its subsidiary Bradesco Vida e Previdencia. It offers health insurance policies through Bradesco Saude and its subsidiaries for small, medium or large companies. It provides automobile, property/casualty and liability products through its subsidiary Bradesco Auto! /RE. It a! lso offers certain automobile, health, and property/casualty insurance products directly through its Website.

Best Bank Companies To Own In Right Now: State Street Corporation(STT)

State Street Corporation, a financial holding company, provides various financial products and services to institutional investors worldwide. The company?s Investment Servicing business line provides products and services, including custody, product- and participant-level accounting; daily pricing and administration; master trust and master custody; record-keeping; foreign exchange, brokerage, and other trading services; securities finance; deposit and short-term investment facilities; loan and lease financing; investment manager and alternative investment manager operations outsourcing; and performance, risk, and compliance analytics. This segment also offers shareholder services, which comprise mutual fund and collective investment fund shareholder accounting. Its Investment Management business line provides a range of investment management, investment research, and other related services, such as securities finance; and strategies for managing passive and active financ ial assets, such as enhanced indexing and hedge fund strategies for U.S. and global equities and fixed-income securities. The company serves mutual funds, collective investment funds and other investment pools, corporate and public retirement plans, insurance companies, foundations, endowments, and investment managers. State Street Corporation was founded in 1832 and is headquartered in Boston, Massachusetts.

Advisors' Opinion:- [By Holly LaFon]

In the fourth quarter, Yacktman�� biggest additions to his holdings were Research In Motion (RIMM) and Avon Products (AVP). He also surprised followers by venturing into financials, with new positions in Goldman Sachs (GS), Bank of America (BAC), State Street Corp. (STT) and Northern Trust Corp. (NTRS).

- [By Jon C. Ogg]

Two additional banks with ratings previously placed on review for a credit rating downgrade also were�included in the review: Bank of New York Mellon Corp. (NYSE: BK) and State Street Corp. (NYSE: STT).

Best Bank Companies To Own In Right Now: Northern Trust Corporation(NTRS)

Northern Trust Corporation, through its subsidiaries, provides asset servicing, fund administration, asset management, and fiduciary and banking solutions for corporations, institutions, families, and individuals worldwide. The company offers corporate and institutional services, including global master trust and custody, trade settlement, and reporting; fund administration; cash management; investment risk and performance analytical services; investment operations outsourcing; and transition management and commission recapture services. It also provides personal financial services, such as personal trust, investment management, custody, and philanthropic services; financial consulting; guardianship and estate administration; brokerage services; and private and business banking services, as well as customized products and services. In addition, the company offers active and passive equity and fixed income portfolio management, as well as alternative asset classes comprisin g private equity and hedge funds of funds, and multi-manager products and advisory services. Further, it engages in fund administration, investment operations outsourcing, and custody business that provides specialized services to a range of funds, which include money-market, multi-manager, exchange-traded funds, and property funds for on-shore and off-shore markets. Additionally, the company provides administrative and middle-office services consisting of trade processing, valuation, real-time reporting, accounting, collateral management, and investor servicing. Northern Trust Corporation was founded in 1889 and is based in Chicago, Illinois.

Advisors' Opinion:- [By Holly LaFon]

In the fourth quarter, Yacktman�� biggest additions to his holdings were Research In Motion (RIMM) and Avon Products (AVP). He also surprised followers by venturing into financials, with new positions in Goldman Sachs (GS), Bank of America (BAC), State Street Corp. (STT) and Northern Trust Corp. (NTRS).

Best Bank Companies To Own In Right Now: Goldman Sachs Group Inc.(The)

The Goldman Sachs Group, Inc., together with its subsidiaries, provides investment banking, securities, and investment management services to corporations, financial institutions, governments, and high-net-worth individuals worldwide. Its Investment Banking segment offers financial advisory, including advisory assignments with respect to mergers and acquisitions, divestitures, corporate defense, risk management, restructurings, and spin-offs; and underwriting securities, loans and other financial instruments, and derivative transactions. The company?s Institutional Client Services segment provides client execution activities, such as fixed income, currency, and commodities client execution related to making markets in interest rate products, credit products, mortgages, currencies, and commodities; and equities related to making markets in equity products, as well as commissions and fees from executing and clearing institutional client transactions on stock, options, and fu tures exchanges. This segment also engages in the securities services business providing financing, securities lending, and other prime brokerage services to institutional clients, including hedge funds, mutual funds, pension funds, and foundations. Its Investing and Lending segment invests in debt securities, loans, public and private equity securities, real estate, consolidated investment entities, and power generation facilities. This segment also involves in the origination of loans to provide financing to clients. The company?s Investment Management segment provides investment management services and investment products to institutional and individual clients. This segment also offers wealth advisory services, including portfolio management and financial counseling, and brokerage and other transaction services to high-net-worth individuals and families. In addition, it provides global investment research services. The company was founded in 1869 and is headquartered in New York, New York.

Friday, October 25, 2013

Brent Below $107 On Uncertainty In The US

Positive economic data from China helped Brent crude steady after US crude stockpile data put pressure on prices on Thursday. Brent crude oil traded at $106.99 on Friday morning at 7:45 GMT on Friday morning.

Reuters reported that PMI data from China showed the region's manufacturing sector expanded at its fastest pace in seven months.

Related: #PreMarket Primer: Friday, October 25: Microsoft Earnings Surpass Expectations

A rise in new orders helped the PMI rise to 50.9 in October, up from 50.2 in September. The data indicated that the number two oil consumer was stabilizing; however most are expecting to see the nation's central bank maintain a cautious stance on monetary policy in the coming months.

A lack of geopolitical tension has removed a lot of Brent's strength as investors worry less about supply interruptions in the Middle East. The tense relationship between the US and Iran once kept a floor under oil prices, but recent high level talks between the two have provided hope that their icy relationship is finally starting to thaw.

Uncertainty over the US budget has also kept a lid on prices as the nation has yet to determine how to proceed with Congress bitterly divided. Although policy makers in Washington have pledged never to allow a shutdown like the one seen in October to happen again, the two sides are no closer to reaching an agreement than they were at the beginning of the shutdown.

The prospect of another budget showdown coupled with uncertainty about the scope of the damage done by October's Federal government closure has weighed on Brent prices.

Posted-In: Federal ReserveNews Commodities Forex Global Pre-Market Outlook Markets Best of Benzinga

(c) 2013 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Around the Web, We're Loving... Learn to Use Trading Platforms Like Hedge Fund Traders do Rumsfeld: Denial of Benefits to Fallen Soldiers' Families 'Inexcusable' Come See How the Pro's Trade in this Exclusive Webinar Facebook, Baidu Lead Big Caps Beating Shutdown What Should You Know About AMZN? Most Popular UPDATE: Jefferies Downgrades Exelon Corporation on Valuation Earnings Scheduled For October 24, 2013 Apple Rumored To Ship 10 Million iPad Air Units In Q4 Icahn Makes a Big Profit on Netflix, Offers Lesson in Selling 3 Small Caps With Dividends over 4% That Could Grow Even Bigger Top Tweets From Stocktoberfest 2013 Related Articles (BNO + BROAD) Brent Below $107 On Uncertainty In The US ECB Banking Tests To Be Harder Than Anticipated Brent Recovers On Strong Chinese PMI Gap Between US and Brent Widens Euro's Strength Makes Some Nervous Euro Comes Out Strong Amid US Uncertainty View the discussion thread. Partner Network #marketfy-ae-block { display: none; border: 2px solid #0a3f75; overflow: hidden; width: 300px; height: 125px; text-align: center; background-color: #45719E; position: relative; z-index: 1; } #marketfy-ae-block a { display: block; width: 300px; height: 125px; position: relative; z-index: 2; color: #ffffff; text-decoration: none; } #marketfy-ae-block-countdown-text { color: #f9fc99; padding: 0px 0 0 0; font-size: 19px; font-weight: bold; line-height: 19px; } #marketfy-ae-block-countdown-text-start { font-size: 12px; } #marketfy-ae-block-countdown { padding: 5px 0 5px 0; font-size: 26px; } #marketfy-ae-block-signup { padding: 5px 47px; } #marketfy-ae-block-signup:hover { background-color: #457a1a; } #marketfy-ae-block #marketfy-ae-block-logo { display: block; padding: 3px 0 0 0; margin: 0; } #marketfy-ae-block-logo { text-indent: -9999px; } #marketfy-ae-block-free { display: block; position: absolute; top: 7px; right: -23px; width: 80px; height: 16px; line-height: 16px; text-align: center; opacity: 1; -webkit-transform: rotate(45deg); -moz-transform: rotate(45deg); -ms-transform: rotate(45deg); transform: rotate(45deg); font-size: 13px; font-weight: normal; color: #333333; background-color: yellow; z-index: 500; text-shadow: 1px 1px #999999; } #marketfy-ae-block-arrow { position: relative; width: 60px; height: 60px; z-index: 10; margin: -80px 0 13px -21px; } #marketfy-ae-block-arrow img { height: 60px; width: auto; } Marketfy's InternationalTraders & Investors Summit Register for this FREE Event!

Hosted by Marketfy

Hosted by Marketfy

Tuesday, October 22, 2013

5 Best Undervalued Stocks To Buy Right Now

Good Revenue, But In-Line Margins

Qualcomm reported 35% annual revenue growth for the fiscal third quarter, as well as 2% sequential growth, resulting in a 3% beat relative to the average sell-side estimate. Growth was fueled by the chip business (QCT), as revenue rose 47% and 8% on strong unit and ASP growth. Licensing revenue was mixed (up 17% and down 9%) as the company saw minimal year-on-year ASP leverage and a double-digit sequential decline in volume.

SEE: A Look At Corporate Profit Margins

5 Best Undervalued Stocks To Buy Right Now: Dollar Tree Inc.(DLTR)

Dollar Tree, Inc. operates discount variety stores in the United States and Canada. Its stores offer merchandise primarily at the fixed price of $1.00. The company operates its stores under the names of Dollar Tree, Deal$, Dollar Tree Deal$, Dollar Giant, and Dollar Bills. Its stores offer consumable merchandise, including candy and food, and health and beauty care, as well as household consumables, such as paper, plastics, household chemicals, in select stores, and frozen and refrigerated food; variety merchandise, which includes toys, durable housewares, gifts, party goods, greeting cards, softlines, and other items; and seasonal goods, such as Easter, Halloween, and Christmas merchandise. As of April 30, 2011, it operated 4,089 stores in 48 states and the District of Columbia, as well as 88 stores in Canada. The company was founded in 1986 and is based in Chesapeake, Virginia.

Advisors' Opinion:- [By Rich Duprey]

Deep discounter Dollar Tree (NASDAQ: DLTR ) announced today that its current chief operating officer, Gary Philbin, will now also carry the title of president, a position previously held by company CEO Bob Sasser.

- [By Paul Ausick]

Dollar General�� share price is up less than 6% in the past 12 months, but since the beginning of the year shares have risen more than 22%. And even then, Dollar General�trails Dollar Tree Inc. (NASDAQ: DLTR) in share price growth since January 1. Dollar Tree stock is up 30%.

5 Best Undervalued Stocks To Buy Right Now: Schlumberger N.V.(SLB)

Schlumberger Limited, together with its subsidiaries, supplies technology, integrated project management, and information solutions to the oil and gas exploration and production industries worldwide. The company?s Oilfield Services segment provides exploration and production services; wireline technology that offers open-hole and cased-hole services; supplies engineering support, directional-drilling, measurement-while-drilling, and logging-while-drilling services; and testing services. This segment also offers well services; supplies well completion services and equipment; artificial lift; data and consulting services; geo services; and information solutions, such as consulting, software, information management system, and IT infrastructure services that support oil and gas industry. Its WesternGeco segment provides reservoir imaging, monitoring, and development services; and operates data processing centers and multiclient seismic library. This segment also offers variou s services include 3D and time-lapse (4D) seismic surveys to multi-component surveys for delineating prospects and reservoir management. The company?s M-I SWACO segment supplies drilling fluid systems to improve drilling performance; fluid systems and specialty tools to optimize wellbore productivity; production technology solutions to maximize production rates; and environmental solutions that manages waste volumes generated in drilling and production operations. Its Smith Oilfield segment designs, manufactures, and markets drill bits and borehole enlargement tools; and supplies drilling tools and services, tubular, completion services, and other related downhole solutions. The company?s Distribution segment markets pipes, valves, and fittings, as well as mill, safety, and other maintenance products. This segment also provides warehouse management, vendor integration, and inventory management services. Schlumberger Limited was founded in 1927 and is based in Houston, Texas.

Advisors' Opinion:- [By Tyler Crowe and Aimee Duffy]

About 1% of all drilling operations are powered by natural gas. By shifting all drilling operations over to natural gas, the industry could save as much as $1.6 billion a year. The idea has such appeal that both Haliburton (NYSE: HAL ) and Schlumberger (NYSE: SLB ) have said that they would be willing to test sites with Apache for free. In this video, Fool.com contributor Tyler Crowe talks about how the industry could convert to natural-gas-powered operations, and highlights companies to look out for that could benefit from this movement.

- [By Arjun Sreekumar]

For instance, though oilfield services firms Schlumberger (NYSE: SLB ) and Halliburton (NYSE: HAL ) have shown a keen interest in developing China's shale resources, the absence of clearly defined and enforceable patent and property protection laws has given them reason to pause. �

10 Best Canadian Stocks To Watch For 2014: Caterpillar Inc.(CAT)

Caterpillar Inc. manufactures and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives worldwide. It operates through three lines of businesses: Machinery, Engines, and Financial Products. The Machinery business offers construction, mining, and forestry machinery, including track and wheel tractors, track and wheel loaders, pipelayers, motor graders, wheel tractor-scrapers, track and wheel excavators, backhoe loaders, log skidders, log loaders, off-highway trucks, articulated trucks, paving products, skid steer loaders, underground mining equipment, tunnel boring equipment, and related parts. It also manufactures diesel-electric locomotives; and manufactures and services rail-related products and logistics services for other companies. The Engines business provides diesel, heavy fuel, and natural gas reciprocating engines for Caterpillar machinery, electric power generation systems, marine, petrol eum, construction, industrial, agricultural, and other applications. It offers industrial turbines and turbine-related services for oil and gas, and power generation applications. This business also remanufactures Caterpillar engines, machines, and engine components; and offers remanufacturing services for other companies. The Financial Products business provides retail and wholesale financing alternatives for Caterpillar machinery and engines, solar gas turbines, and other equipment and marine vessels, as well as offers loans and various forms of insurance to customers and dealers. It also offers financing for vehicles, power generation facilities, and marine vessels. The company markets its products directly, as well as through its distribution centers, dealers, and distributors. It was formerly known as Caterpillar Tractor Co. and changed its name to Caterpillar Inc. in 1986. Caterpillar Inc. was founded in 1925 and is headquartered in Peoria, Illinois.

Advisors' Opinion:- [By John Maxfield]

Given the news out of China, it should be no surprise that the Dow's worst-performing stock this afternoon is Caterpillar (NYSE: CAT ) . The heavy-machinery company looks to China for a considerable portion of sales and depends on global growth more generally to fuel demand for its products. In addition, as my colleague Dan Caplinger noted earlier today, the fall in gold prices could also have a negative impact on mining activity, an important source of demand for Caterpillar equipment.

5 Best Undervalued Stocks To Buy Right Now: Tupperware Corporation(TUP)

Tupperware Brands Corporation operates as a direct seller of various products across a range of brands and categories through an independent sales force. The company engages in the manufacture and sale of kitchen and home products, and beauty and personal care products. It offers preparation, storage, and serving solutions for the kitchen and home, as well as kitchen cookware and tools, children?s educational toys, microwave products, and gifts under the Tupperware brand name primarily in Europe, Africa, the Middle East, the Asia Pacific, and North America. The company provides beauty and personal care products, which include skin care products, cosmetics, bath and body care, toiletries, fragrances, nutritional products, apparel, and related products principally in Mexico, South Africa, the Philippines, Australia, and Uruguay. It offers beauty and personal care products under the Armand Dupree, Avroy Shlain, BeautiControl, Fuller, NaturCare, Nutrimetics, Nuvo, and Swissgar de brand names. The company sells its Tupperware products directly to distributors, directors, managers, and dealers; and beauty products primarily through consultants and directors. As of December 26, 2009, the Tupperware distribution system had approximately 1,800 distributors, 61,300 managers, and 1.3 million dealers; and the sales force representing the Beauty businesses approximately 1.1 million. The company was formerly known as Tupperware Corporation and changed its name to Tupperware Brands Corporation in December 2005. The company was founded in 1996 and is headquartered in Orlando, Florida.

Advisors' Opinion:- [By Eric Volkman]

Tupperware Brands (NYSE: TUP ) is reaching into its corporate bowl for a fresh payout to shareholders. The company has declared a quarterly dividend of $0.62 per share. This will be paid on July 8 to stockholders of record as of June 19. That amount matches the firm's previous distribution, which was paid in early April. Prior to that, Tupperware Brands was rather less generous, handing out $0.36 per share.

Monday, October 21, 2013

Top 10 Companies To Watch For 2014

Score one for Forbes, at the expense of Barron's. With today's big jump from SolarCity Corp. (NASDAQ:SCTY) shares, an article appearing on the latter's website a few weeks ago alluded to the possibility that the company might need to raise funds to meet certain obligations ... the last thing shareholders want to hear. A few hours later, a commentary at the former's website swooped in to repair the damage being done to SCTY, largely by reframing the issue. Though "right" and "wrong" might be too strong to use as description of how things have played out for the stock in the meantime, using the terms "relevant" and "irrelevant" wouldn't be a stretch - William Pentland's article at Forbes appears to be the more relevant of the two, at least to investors, judging from the stock's action today.

Top 10 Companies To Watch For 2014: Gibraltar Industries Inc.(ROCK)

Gibraltar Industries, Inc. manufactures and distributes building products for the home improvement, highway construction, building materials, architectural industries, and construction industries. The company?s products include a line of bar grating and safety plank grating for use in walkways, platforms, safety barriers, drainage covers, and ventilation grates; expanded and perforated metal used in walkways, catwalks, shelving, fencing, barriers, patio furniture, and other applications; metal lath products for use in exterior stucco, stone, and tile projects; fiberglass grating; and expansion joint systems, bearing assemblies, and pavement sealing systems used in bridge and highway infrastructure construction. Its products also consist of roof and foundation ventilation products and accessories; mail storage solutions comprising single mailboxes and cluster boxes for multi-unit housing; roof edging, underlayment, and flashing; soffits and trim; drywall corner bead; coate d coil stock; metal roofing and accessories; steel framing; rain dispersion products, such as gutters and accessories; and lawn and garden products. The company sells its products through its sales personnel and outside sales representatives to home improvement retailers and building product distributors, as well as to commercial, residential, and transportation contractors. It operates primarily in the United States, Canada, Mexico, and Europe. The company was founded in 1993 and is headquartered in Buffalo, New York.

Top 10 Companies To Watch For 2014: Allos Therapeutics Inc.(ALTH)

Allos Therapeutics, Inc., a biopharmaceutical company, engages in the development and commercialization of anti-cancer therapeutics. It focuses on the development and commercialization of FOLOTYN (pralatrexate injection), a folate analogue metabolic inhibitor. The company?s FOLOTYN is approved in the U.S. for the treatment of patients with relapsed or refractory peripheral T-cell lymphoma (PTCL). It is also developing FOLOTYN in other hematologic malignancies. The company has a strategic collaboration agreement with Mundipharma International Corporation Limited (Mundipharma) to co-develop FOLOTYN. Allos Therapeutics has full commercialization rights for FOLOTYN in the United States and Canada; and Mundipharma have exclusive rights to commercialize FOLOTYN in all other countries. Allos Therapeutics and Mundipharma are seeking regulatory approval to market FOLOTYN in the European Union and other geographies for the treatment of patients with relapsed or refractory PTCL; and are developing FOLOTYN in other potential indications. The company was formerly known as HemoTech Sciences, Inc. and changed its name to Allos Therapeutics, Inc. in October 1994. Allos Therapeutics, Inc. was founded in 1992 and is headquartered in Westminster, Colorado.

Top Casino Stocks To Watch Right Now: CO2 Group Ltd (COZ.AX)

CO2 Group Limited operates as a carbon solutions company in Australia, New Zealand, and Asia. It designs, develops, and manages greenhouse abatement projects; establishes carbon forests; and provides carbon trading solutions. The company offers carbon services for carbon forests, land management related greenhouse abatement projects, landfill, agricultural systems, rangelands, savannah management, biomass energy systems, and renewable energy projects; and environmental services. It manages approximately 26,400 hectares of forest carbon sink plantings in New South Wales and Western Australia; and protects approximately 4,200 hectares of remnant native vegetation. The company serves energy producers and retailers, as well as industrial consumers. CO2 Group Limited is based in Perth, Australia.

Top 10 Companies To Watch For 2014: Checkpoint Systms Inc.(CKP)